What things to discover playing with good HELOC once the a deposit

House guarantee lines of credit (HELOCs) can help to save a single day should you want to accept an intensive recovery otherwise fix in your home.

But not, HELOCs can help with more one. Their self-reliance allows you to pertain these to certain costs, also an advance payment to own one minute possessions. This method try unconventional, however,, occasionally, it may be a wise financial decision.

- Apart from money solutions otherwise renovations, a great HELOC can be used to safeguards an additional mortgage.

- When you find yourself unusual, people take advantage of which home loan method.

- Oftentimes, the costs of employing a great HELOC while the a deposit exceed people pros.

Typically, somebody use 2nd mortgage loans eg good HELOC otherwise property collateral loan in order to easily accessibility bucks. Each other mortgage factors make use of your home due to the fact security and need good lowest number of security of your house. Thus, while you are deciding whether or not playing with good HELOC getting an advance payment are right for you, understand that defaulting into financing can lead to a foreclosure on your own home.

Just how do household guarantee credit lines really works?

HELOCs was secured rotating credit lines, definition you can access bucks as you need. Loan providers accept your for a fixed borrowing limit oriented partly into your home guarantee. You might acquire from it normally since you need throughout your own mark months, that can past around a decade. Into the draw several months, you routinely have while making attention repayments.

As you may many times obtain from your own HELOC, they provide self-reliance. As a result of one to independence, of several individuals play with HELOCs getting highest-measure family renovations which may is unexpected expenditures. not, while the revolving lines of credit, HELOCs normally safety numerous novel needs for your home and you can past. Whenever you are to acquire a new possessions and you are clearly worried about upfront will set you back such as your deposit, a HELOC will help.

When you discover a beneficial HELOC, the bank removes good lien on the domestic until you pay back your HELOC, causing them to safer finance. Along with your house acting as guarantee, lenders will start the newest foreclosure process if you can’t pay back.

Using a great HELOC to possess an advance payment

Having fun with good HELOC to fund your downpayment makes way more feel in certain situations as opposed to others. An effective HELOC’s independence will make it specifically used for financing propertiesing up to your advance payment for properties you plan to help you flip or book to other renters are challenging. Good HELOC could possibly get pay the advance payment rapidly, closure new pit between once you pick a house whenever it initiate earning money.

You are able to have fun with a beneficial HELOC to afford down payment to possess a special private household you plan on living in. You will possibly not must hold back until your domestic offers before buying the next family, or you might have to move around in within this a specific schedule to possess a unique occupations. While happy to disperse, a good HELOC can help you link committed between promoting your own old house and buying your new you to.

Pros and cons of employing good HELOC to possess a home loan

While good HELOC could help you browse problematic household-purchasing items, borrowing from the bank currency facing your own home’s collateral comes with particular risks. Before applying, La Junta Gardens Colorado loans make sure you considered the advantages while the challenges to determine if a good HELOC is right for you.

Experts of employing a beneficial HELOC for home financing

There are various positive points to using good HELOC having an all the way down fee. A beneficial HELOC is relatively reasonable risk so you’re able to loan providers since your family serves as guarantee so you can support the mortgage. As a result of one to added protection, lenders costs apparently low-rates of interest towards HELOCs than the unsecured lines of credit you can or even slim toward, for example credit cards otherwise unsecured loans.

Due to the fact personal lines of credit, HELOCs also provide professionals more than household equity funds and other simple loans. With HELOCs, you pay right back the cash you employ (and attract), and you also are not necessary to use a complete amount readily available. Loan providers could possibly get approve a premier borrowing limit when you yourself have generous security of your home and see most other conditions. Appeal costs start once you use your HELOC, but you dont make full repayments up until just after the label ends.

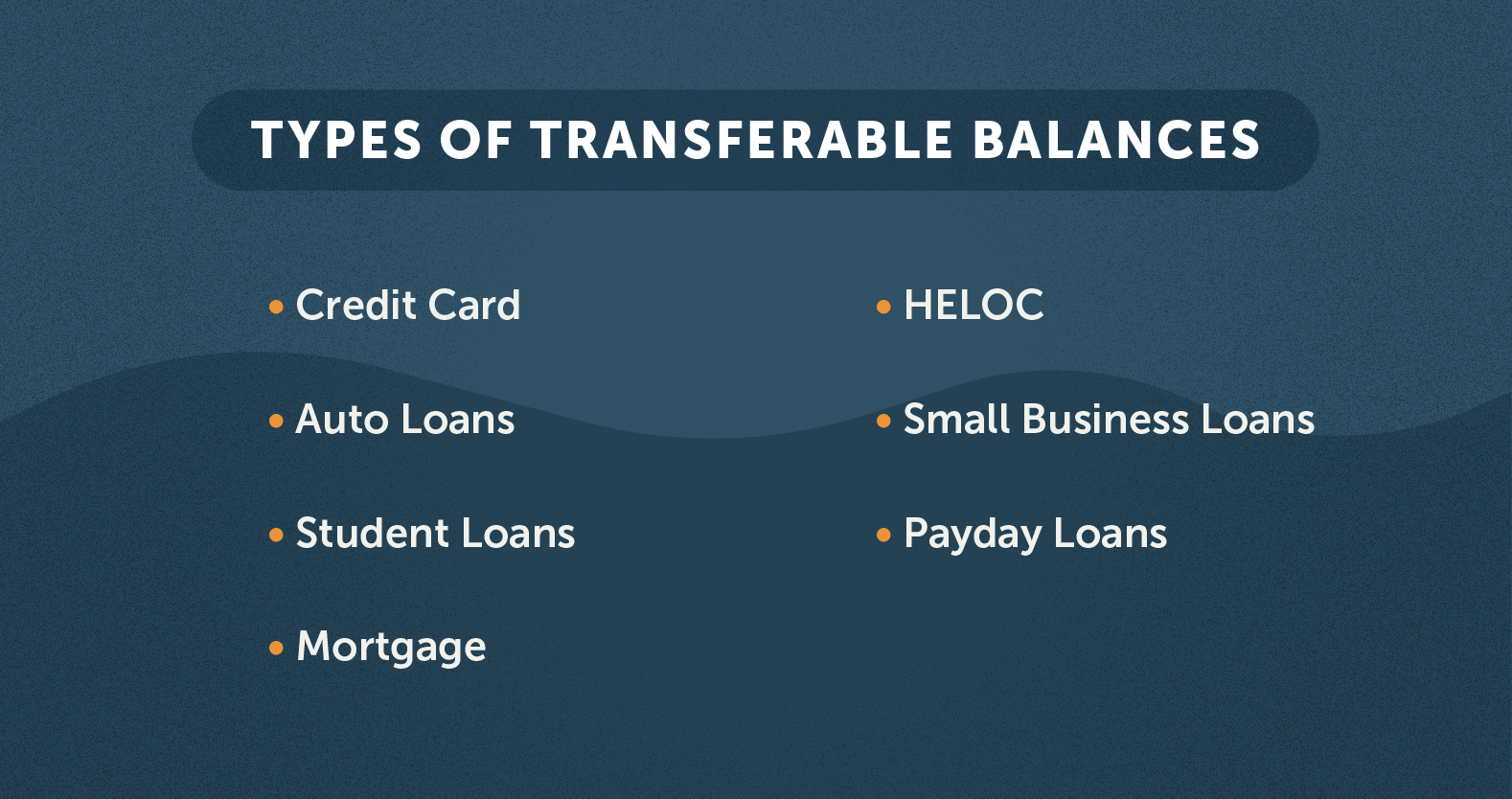

Since you may borrow from your HELOC as required, you can use it not merely having a downpayment but to have move-in charge, fixes, and you can renovations on your the fresh assets. Even having fun with HELOC to repay home financing is possible.

For individuals who method an excellent HELOC with the exact same care and attention just like the any personal line of credit if you take aside simply what you want and can pay-off, having fun with a beneficial HELOC for a down-payment could be a silky procedure.