Restoration Financing: If you take an out in-domestic financing from the recovery providers?

Show this post

People that have currently borrowed doing the most repair financial financing restrict off $31,000, otherwise those who don’t want to take-out an additional financial loan, are inclined to rather need an in-household loan given by the interior framework enterprise he has engaged.

4 Recovery Organizations with in-Family Financing

While this appears like a quick and you may convenient services at committed, taking up like that loan in order to done your home improvements will get turn into a bad idea.

In-house renovation loans out of interior planning providers commonly popular, listed below are 4 recovery companies that give when you look at the-family restoration fund when you look at the Singapore:

Must i bring an in-home loan away from recovery company?

Be mindful and you can sensible on it relates to delivering one mortgage. Not to ever move to fast, but, when you are given a call at-house recovery mortgage from your interior designer, cannot carry it up unless you haven’t any other solution. The following is why.

step one. In-mortgage loans try backed by signed up moneylender

First of all, why don’t we have one point straight. To help you legitimately give cash in Singapore, agencies need to apply for ideal licences. This type of licences are just kepted getting loan providers, instance finance companies, boat loan companies and licensed moneylenders.

Therefore, interior design businesses try unlikely to have the correct certification to promote signature loans in addition to their recovery characteristics. And also for the rare couple who do, they will certainly almost certainly encourage both tracts off organizations once the hey, it is a different sort of income source, consider?

In that case, just how do interior planning enterprises offer an in-house recovery loan? The most likely answer is that they lover up with a beneficial lender, one that’s authorized so you can furnish unsecured loans towards the personal.

It is possible one to an inside framework organization get lover upwards having a lender to offer the repair financing packages in order to subscribers however if you will find people out there, we have not observed them.

Yet not, its more likely that the party providing the loan is an authorized moneylender. Given just how very competitive brand new signed up moneylending industry is, it’s not hard to believe moneylenders partnering up with interior planning agencies in an effort to visited a whole lot more prospective customers.

dos. Higher interest rates

Nothing is incorrect along with your indoor designer giving a loan regarding a licensed moneylender per se, as long as the brand new moneylender are securely subscribed plus a good updates, you can be assured out-of a specialist and you may over-board experience.

The issue is your interest recharged from the authorized moneylenders is much higher than those billed by financial institutions and you may financial institutions in many cases, with ease outstripping your own credit card rates!

You should know you to definitely licensed moneylenders can charge desire all the way to cuatro% 30 days compared to the bank repair fund which go to own ranging from step 3.2% to help you cuatro.55% per year.

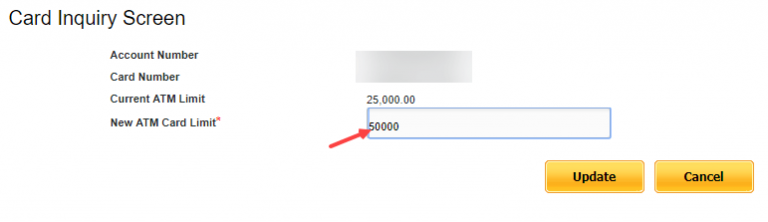

Listed here is an instant research between a licensed moneylender loan and you may a lender recovery financing, with the particular providers’ on the internet hand calculators.

Indoor Developer In the-Domestic Restoration Financing

It really should not be alarming, considering how well-offered the market was, which have many lender and you can financial institutions offering competitively priced repair funds right here.

Submit an application for Restoration Mortgage from inside the Singapore

Irrespective of where you take the renovation financing away from – lender, registered moneylender, or your renovation organization – you really need to look out for another about a repair mortgage provide.

1. Rate of interest

While the we have depicted a lot more than, the speed on the a remodelling mortgage (or almost any borrowing from the bank, even) is the solitary the very first thing.

Financing with a high rate of interest is much more tough to repay, and even a speed which is merely a little higher normally change so you’re able to a difference inside buck terminology.

dos. Financing period

Loan tenure basically is the time you have to pay right back the mortgage. Financial institutions generally make you step one to five years about how to pay off your renovation loan. This allows you to definitely pass on the debt aside, ultimately causing straight down monthly money which can be more straightforward to do.

However, note that the longer you take to invest straight back, more month-to-month desire you will have to shell out in total. However, it is best to determine a lengthier period so as never to overload your self.

Many authorized moneylenders is reluctant to offer that loan tenure stretched than just 1 year, so your restoration financing monthly money will be really higher possibly even larger than you might comfortably pay for.

Now, if you feel that the new hard money lenders for personal loans Chase PA monthly payments for the restoration mortgage is actually higher, never simply take one to restoration mortgage, as you are in danger out of dropping towards a personal debt trap, and not-end penalty charge.

My indoor creator provided me personally a call at-household restoration loan. How to proceed?

Into rare opportunity your own indoor developer provides a call at-household restoration mortgage, be sure to meticulously data the conditions and terms of mortgage, particularly the interest rate and you can loan course.

In case your lender was a good moneylender, you’ll be able to read the Ministry out of Law’s specialized directory of registered moneylenders. Ensure that new moneylender isnt suspended otherwise blacklisted.

While you are are advised the in the-domestic mortgage exists by the a lender, don’t simply bring your interior designer’s term for it. Alone talk with the lending company at issue, and make certain the rate, tenure, fees and charges, and other small print are the same.

However, eg i told you, in-domestic restoration finance are not very common for the Singapore, so that your possibility of experiencing you’re probably be lowest.