Pool Funding: How to Score a pool Financing?

Ok, thus you decide locate a swimming pool. Definitely, I do believe that’s a good idea. Notwithstanding, you are however going to have to pay for it for some reason (however if might disregarded that absolutely nothing section of they).

However, absolutely, pond financing is a vital part out of talk whenever you are bringing willing to make such as a purchase. This post is meant to help you comprehend the activity of pool capital and exactly how they normally works best for extremely people.

After having hung a tiny more than 600 pools, all of our users features covered its pools inside the a choice from manners. A number of the pathways generally removed are:

- House guarantee line

- 2nd mortgage

- Consumer loan

- Up front (cash)

- Bank card

How to buy a share?

Pond people normally pay for the swimming pools using property equity range, next mortgage, unsecured loan, with your own money (cash), or bank card. If you’re planning to invest in a massive portion of their enterprise, get pre-recognized prior to that have people away having quotes. So it ensures you might support the needed capital.

Second Mortgages/Security Lines

As everyone knows too well, for the expensive houses amounts of new 2000s it was effortless to track down home financing for decades.

The latest houses , causing people to get rid of a lot of guarantee when you look at the their property. That it drop in home philosophy provides influenced pond money inside the a great sort of suggests.

To give an illustration, I experienced several pool buyers promote me a deposit in 2009 simply to afterwards discover that there wasn’t sufficient equity in the their home to get the loan. Hence, there is a lot of our second home loan users submit an application for financing just after our loans Trinidad very own earliest cellphone conversation.

In that way, no body wastes go out trying to decide on a swimming pool and you will a pool builder simply to discover they don’t have the required money.

A broad rule of thumb proper offered the second mortgage would be the fact unless of course you’ve been in the home for over six ages, otherwise except if you have founded a lot of household security when you look at the a primary timeframe, it’s very unrealistic you’ll be eligible for such financing (this means, you simply will not have sufficient equity).

Signature loans

If you can’t get one minute financial otherwise house-equity range, otherwise don’t want to safer a loan to your house you may want to believe unsecured loans. These types of funds can be basically be obtained and no guarantee with no assessment

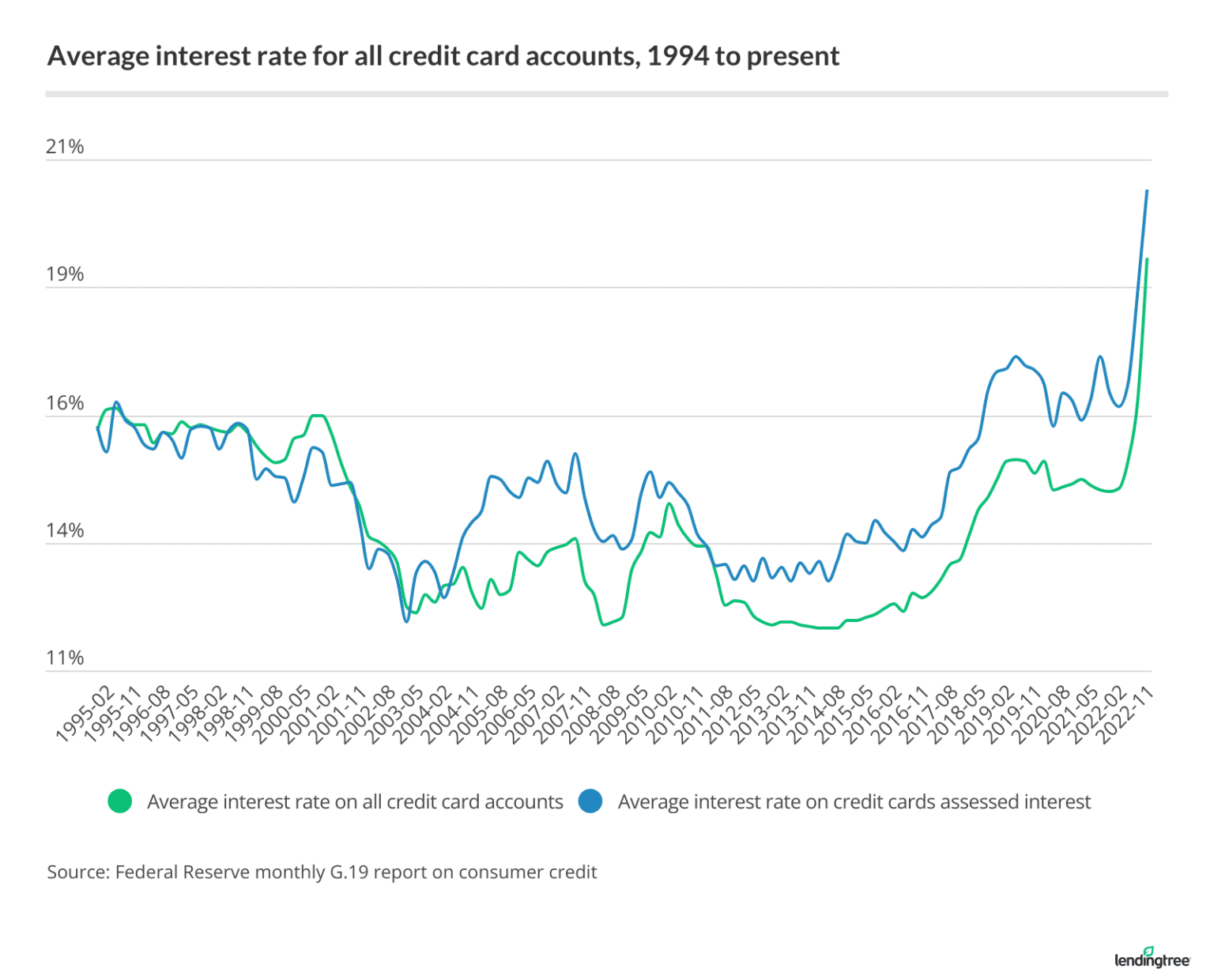

Prices to have unsecured loans become more than a protected financial as the mortgage are riskier for the financial in the skills from standard. At the article’s most recent update (), discover personal loans with repaired conditions carrying out just like the lower since the 2.99% annually. Interest levels is rise rapidly in the event the borrowing from the bank is not stellar, so you could need certainly to look at your rating in advance of seeking to unsecured funding.

We focus on HFS Monetary, because they provide uniquely-prepared signature loans specifically made to finance advancements. Fixed interest rates initiate at 2.99% annually and you may payment will likely be offered over doing 20 years, with no prepayment penalties

Loan limits has just strike a nearly all-time most of $500,000. thus unless you are building a swimming pool complement a thread villain (including whales and you can laser beams and you can whatnot), HFS will probably be able to finance your project.

Banking institutions and you can borrowing from the bank unions constantly lay the floor for interest levels into signature loans at about 10% a-year, with financing fees terminology no longer than simply seven many years to possess an excellent restriction number of about $35,000. If you’ve discover some of all of our prices books and then have integrated landscaping and you may accessories on your own finances, you’ll recognize how restricting this might be.

- Check with your local borrowing from the bank commitment.

- Speak to your regional lender, if at all possible one to you have got a relationship having.

- Seek the advice of a national bank. On Lake Pools, we advice HFS Monetary.

A: Pond businesses do not render correct in-house’ capital. When they state they are doing, they’ve been almost certainly discussing another organization which they work on. We’ve got hitched with HFS Monetary to simply help pond people money the plans.

A: Really banking companies and creditors can do pre-approvals nearly immediately, nevertheless when you are considering 2nd mortgage loans, home appraisals can take to a few weeks.

Our company is viewing more autonomy regarding banks now than the just what we saw of 20092011. However, if you are serious about capital a swimming pool purchase, begin the process now and make certain to test any possibilities. All the best!

Within Lake Swimming pools, i create community-category fiberglass swimming pools getting customers across the United states. When you’re looking for to shop for a fiberglass pool, you can visit all of our pool designs, was the pool pricing calculator, or demand customized rates and recommendations by using the option less than.