Purchasing a house that have an effective Pre-Accepted compared to Pre-Certified Financing

To invest in a house having good Pre-Approved vs Pre-Accredited Loan

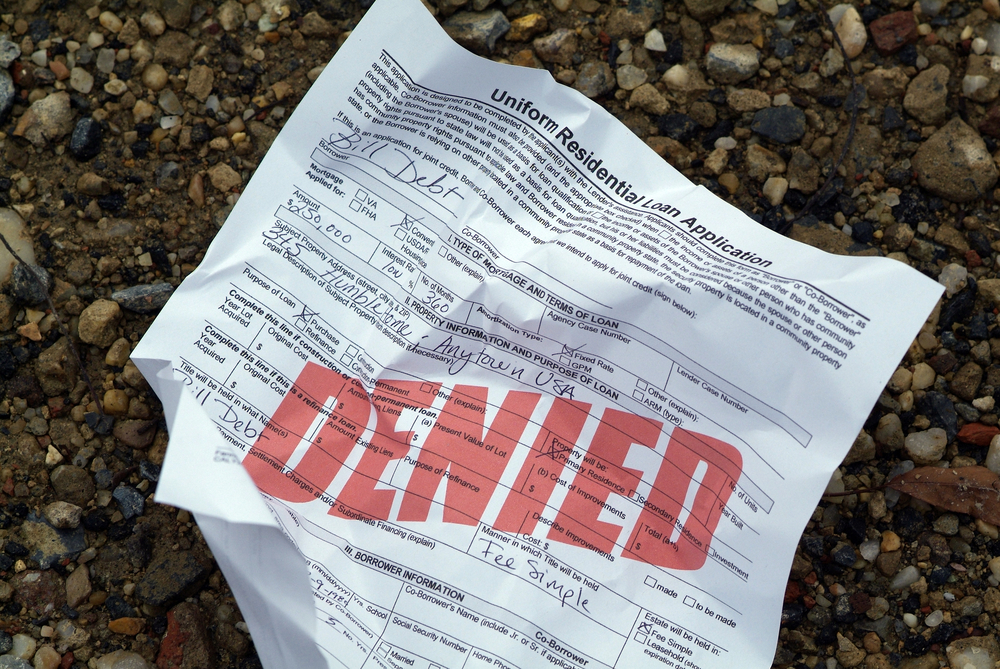

To shop for a property for the first time are an intricate and you can possibly overwhelming experience. Discover all kinds of basic-timer problems which might be easy to generate, out of evaluation what to move-inside dates. Probably the most well-known earliest-big date house client error are putting in a bid which have an excellent pre-recognized loan. Discover an unfortunately preferred misconception you to a pre-qualified loan is enough to create a significant move on to shop for a property.

Pre-Qualification try an advertising Tactic

Once you located an offer to have a great pre-accredited mortgage, and this can be very enjoyable. The number is higher. The financial institution or bank states they’ve got examined your finances and you will you are a good-to-visit pick a house with the financial. However, hold off. Pre-qualification would depend just for the a generation always check. You have got adequate money so you’re able to possibly become acknowledged. You have found up as a home loan profit lead in a formula. Nevertheless bank has never in reality confirmed that they’re going to stretch you that loan. Putting in a bid on that pre-qualification are a recipe to have a deal falling using whenever an enthusiastic unprepared bank is not prepared to offer a genuine financing.

A good pre-qualification is not a partnership, it’s simply a deal to help you get from doorway. To really create a bid to your property https://speedycashloan.net/loans/mba-loans/, just be pre-recognized. This calls for a credit card applicatoin and you can authoritative loan recognition techniques.

Finding an excellent Pre-Accredited Mortgage Provide

Step one is usually acquiring a deal getting a great pre-accredited loan. You should keep in mind that this is exactly a deal, such as for instance an advertisement, maybe not an actual financing that is available for you. An effective pre-certification you are going to make you a positive amount borrowed. Additionally, it could say that you have been pre-processed and now have entitled to financing promote. This simply means that the earnings, surface-peak credit history, or profit image meets just what lender believes is an excellent a great possibility. Very, he is inviting one to apply for a properly approved loan.

If one makes a bid into a property with good pre-accepted mortgage, there is the complete qualification procedure between both you and a good real financing. So you might as well score ahead of the bargain.

Trying to get Pre-Acceptance

If you want and make a quote to the a property, needed good pre-approved financing. To take action, speak to your prospective lender and you will complete a credit card applicatoin. Your loan administrator will assist you to fill it out truthfully and you can provide all the more info concerning your identity and you will finances. Completing the applying allows the lending company to execute the full analysis of your earnings and you can confidently right back that loan to suit your home mortgage.

The new Feedback and you will Acceptance Procedure

As soon as your software program is recorded, the financial institution will start the process of acceptance. Might examine your earnings and your obligations-to-income ratio. They will test your job balance, what you can do to save, and perhaps the brand new financial balance from others on your household. The name and you will background could be looked when it comes down to financial-exposure red flags. Your own credit will go through a hard-query, which gives a complete-detail declaration of credit history. This will get rid of your credit rating because of the 5-10 facts for about annually, that’s worth your while to have an approved mortgage.

Purchasing a home having an excellent Pre-Accepted Loan

Since the lender keeps approved your loan, you can with confidence build home bids according to research by the final amount. Sellers and their representatives usually takes your own estimates undoubtedly and when a merchant accepts your own quote, the financial institution can fulfill that loan immediately on closure. Contact us today to start the loan application and you will pre-acceptance techniques.