Refinancing property Security Financing: Must Save money, otherwise Your residence?

Texas immediately after seen homesteads because assets to get protected against creditors; but, with the introduction of home security lending into the Tx during the 1997 in accordance with amendments from inside the 1999, 2003, and you will 2007, men and women protections was in fact notably cracked out.

Toward , Texans again voted and work out extreme changes to help you home equity rules towards passage of Suggestion 2. This is due in the higher region into the powerful bank lobby services (and you will mindful text of the offer). Now some of the most powerful consumer defenses in the country is actually went so banks earnings.

I detail by detail the changes for the laws and just how it impression first-day borrowers who take out a property security loan just after within the all of our previous blog site How Household Guarantee Credit within the Texas possess Permanently Altered. One tall improvement in what the law states ‘s the capability to refinance property collateral financing for the a non-house collateral otherwise old-fashioned loan not as much as Post XVI, subsection 50(a)(4) of your own Texas Constitution. New just after property equity loan, constantly property guarantee mortgage motto is finished, it is one the best thing?

Criteria to help you Refinance regarding a property collateral financing so you can a traditional loan:

- Must hold off a year from the original financing

- Zero advance of new currency but to invest settlement costs

- The fresh dominating balance can not exceed 80% from property’s reasonable market price

- 12-date re-finance disclosure requirements

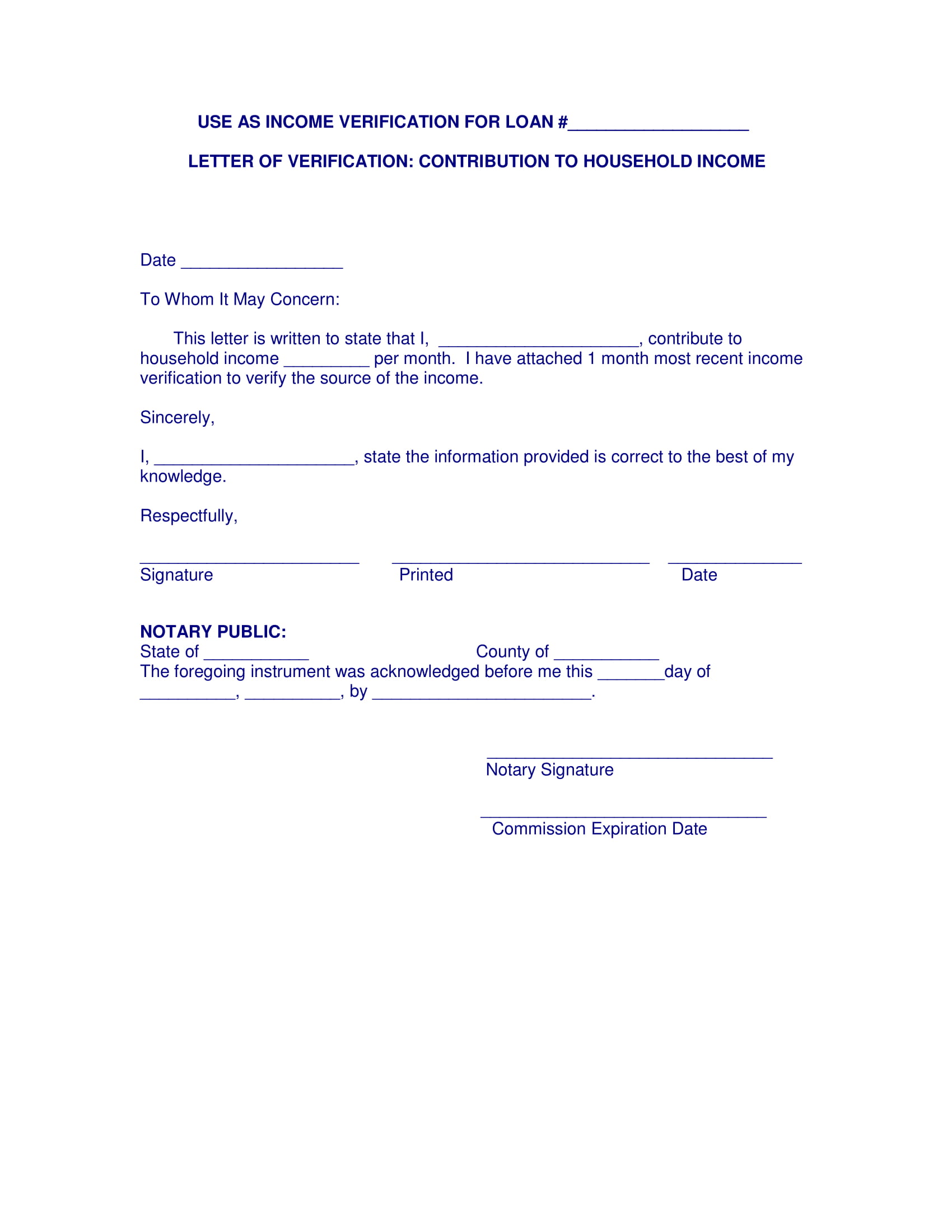

- Affidavit conducted by the manager and you can/or partner

As to the reasons Banking companies Believe you need to Refinance

Depending on the financial business, customers may benefit throughout the lower interest rates that conventional fund has more domestic guarantee finance. Better, how wonderful ones to provide to give up several of its earnings to aid people. Doubtful out of an enthusiastic ulterior purpose? You should be!

The fact is that with that one, finance companies features a different excuse to help you re-finance the loan and you will earn the fresh charges. So very first, it speak your to your with your house such as a check out so you’re able to borrow money so you can consolidate personal debt. (Pay off costs toward items you did not pay for.) Next remove some funds to find much more things did not otherwise pay for. After that, after you shell out on your the fresh new personal debt to own per year, it label your up with a different choice so you’re able to re-finance you to old household equity loan with the another antique loan at the a lower life expectancy rate of interest, so you save money. Musical an effective, best?

Why you need to be careful

Sure, you could potentially almost certainly obtain a lower interest rate toward a traditional refinance over a property collateral financing. However, a lesser rate of interest will not verify you can easily pay smaller in the the long run. You ought to reason behind the price of the newest refinancing and determine exacltly what the breakeven are. Such as, if you can save yourself $50 30 days inside attention, and it also will cost you you $step three,five hundred when you look at the charge to shut the mortgage, it requires you 70 days merely to breakeven. Can you remain there within the 70 months?

But there is however more substantial concern than simply charges. Consider as to why finance companies provide lower interest $255 payday loans online same day Nebraska levels when you refinance out of property equity financing. It is because you are letting go of something that the financial institution desires the capability to effortlessly foreclose and you will sue you when it comes down to insufficiency should you get into standard. Not everyone take out a loan likely to enter into default, however if there is sickness, dying, breakup, business loss, etcetera., there are financial non-payments.

One of the precautions put into place with the introduction of house security loans in the 1997 is actually the requirement that the fund be non-recourse; and therefore brand new bank’s only option to gather on the good loan during the default should be to foreclose toward the equity your residence. Yes, losing you reside crappy sufficient, but with a traditional recourse loan, the lending company can be foreclose and you can sue your on the deficiency, when there is one.

A new precaution that is went for many who refinance out of a good domestic equity financing ‘s the need for finance companies to track down a judge’s consent prior to they can blog post your residence getting foreclosure. This provision necessitates the lender file an enthusiastic Expedited Foreclosures Application up against the fresh new borrower. The fresh debtor is offered the chance to file a response that have the brand new courtroom and you can dispute its front in order to a judge before the foreclosures purchase is given. This action is not needed which have a low-house equity financing, and you may without one, a foreclosures can happen really rapidly! Find out more towards foreclosures procedure within the Colorado.

Very, before you could rush out over refinance, believe when it is worth it. Do you ever extremely cut any cash, and will that which you save your self be really worth the protections you’re going to be stopping?