Hiding within the Simple Vision | Shocking Va Loan Funding Fees, Informed me

Sr. Underwriter | FHA De, Va SAR, USDA

Understanding the extra 2.15% percentage back at my Virtual assistant financial try a startling disclosure, including surprise $8,600 towards price of a $400,000 assets.

To possess veterans that has previously used a great Va financing, the newest financial support payment escalates to help you an even more challenging 3.3% when an experienced really does a no advance payment loan. It indicates for a passing fancy $eight hundred,000 amount borrowed, the fee skyrockets in order to $13,200! And these costs take the upper simple financial closing costs, assessment charges, insurance, and.

I remember effect a sense of disbelief and you will frustration, a sentiment We in the future realized is actually shared by many people most other seasoned homebuyers.

Whenever i basic encountered these charges while using a good Virtual assistant mortgage for a house buy into the South Ca, I became astonished. It checked too much, almost penalizing. Despite the initially shock, We delved deeper, discovering factors one led me to pursue brand new Va financing having my personal family during the Lime County.

The newest Va financing payment was a-one-time payment your Experienced, services associate, or survivor will pay towards a beneficial Va-recognized otherwise Virtual assistant direct home loan. That it commission helps you to reduce the cost of the loan getting You.S. taxpayers due to the fact Va home loan system doesn’t require off costs or month-to-month mortgage insurance.

As for my personal background, We have offered because home financing underwriter for two+ decades-evaluating over 10,000 loans during my field-and am together with an experienced of your own United states Marines Reserves.

Let this Virtual assistant financing recipient to walk you as a result of as to why, even after people initial shock, these types of funds usually are a selection for pros for example myself.

My Va Financing Sense

So it personal experience applied the foundation having my personal understanding of Virtual assistant funds, which i have a tendency to today describe in detail.

Back into 2010, we went during the with my into the-legislation once leaving Virginia so you can return with the Western Shore. With a baby and 2-year-old toddler for the tow, we wished a fresh initiate near loved ones within family state regarding California. It assisted you go back toward the feet, and soon sufficient, we had been prepared to get our lay again.

We felt and you will compared one another Virtual assistant and you can FHA funds doing very, once you understand each other bring lower down-payment options as opposed to others.

Drawing out of payday loan online Hasty my personal procedure for choosing anywhere between Virtual assistant and you will FHA financing, let us explore a relative investigation to know its peculiarities.

Relative Analysis- Researching Va and you will FHA Financing

While doing so, out-of a truthful viewpoint, an assessment regarding Virtual assistant and you will FHA financing you can do to help you build the best decision.

ConsumerAffairs will bring an intensive analysis chart, adding breadth to the knowledge of these financing versions. So it chart has the benefit of reveal writeup on the differences, enabling you to come across and therefore mortgage would-be more desirable to own your position.

For every loan kind of also offers distinct professionals designed to several borrower need. The last solutions is dependent on the specific criteria of each and every private or family relations.

Va Mortgage

You to massive difference-and just why my children chosen a great Virtual assistant mortgage-is that they do not require monthly home loan insurance policies. Getting off 5% normally reduce the capital payment to a single.50%.

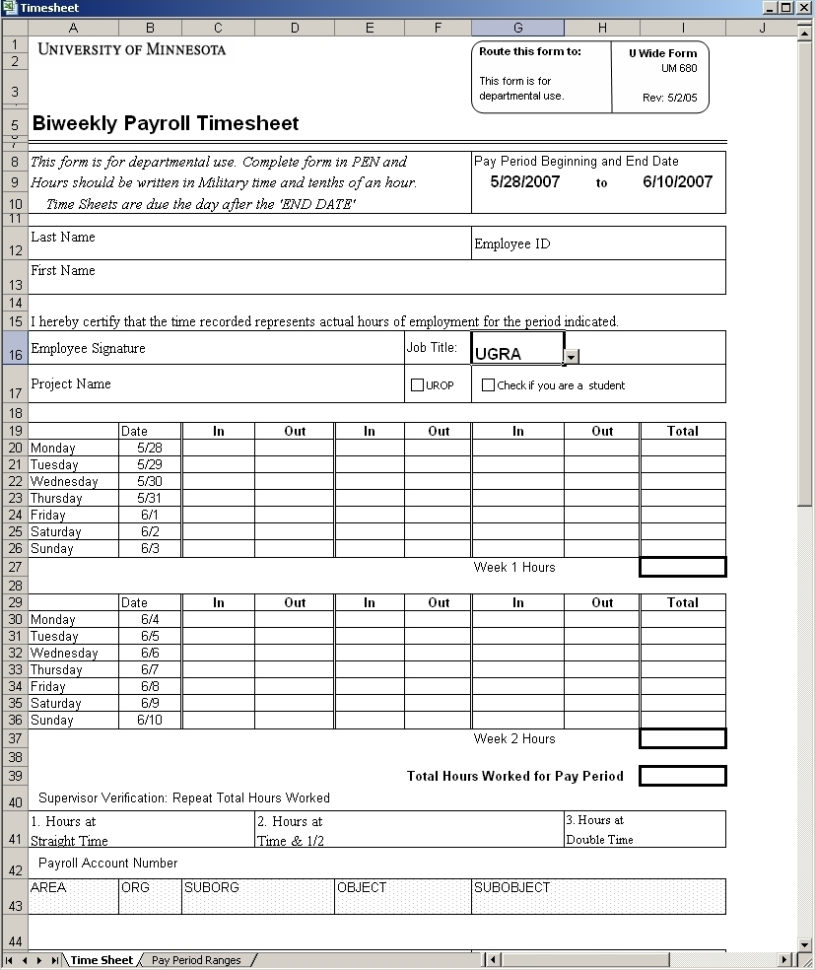

The fresh new table below was regarding You.S. Company away from Pros Facts web site extracting the many levels of capital charges based on down-payment.

FHA Loan

FHA loan amount more than an effective 95% loan-to-really worth proportion (LTV) requires commission off financial insurance coverage towards complete mortgage title. Such as for example, for people who safe a 30-year repaired home loan in the 96.5 LTV ( step 3.5% downpayment ) month-to-month financial insurance policies are expected having thirty years, if you don’t can pay off the mortgage prior to.

- Va money stick out getting maybe not demanding month-to-month home loan insurance rates and you will giving down resource fees in the event you tends to make a down payment, causing them to for example useful having eligible pros and provider people.

- Likewise, FHA finance, making use of their far more lenient borrowing from the bank requirements and you will shorter down repayments, are going to be a very accessible choice for a broader set of homeowners.

Having browsed the difference anywhere between Virtual assistant and you can FHA financing, per loan variety of possess book experts and considerations. To advance help in navigating these types of solutions and you can focusing on how it you are going to impact your money, let us now seek out specific simple products that may bring more clarity and you may aid in choice-and work out.