Virtual assistant fund are those underwritten to guidelines set forth of the Agencies regarding Experts Affairs

Virtual assistant money lack an extra monthly mortgage cost such as the other a few bodies-recognized fund

Due to the fact FHA system isnt set aside having basic-big date people, it’s very preferred in their eyes considering the low-down commission needs and you will competitive interest levels.

Virtual assistant Money. This method was first produced in 1944 as a way to assist returning troops out of WWII quicker assimilate with the civilian existence and you may an element of the brand new G.I. Statement.

USDA money are available for first-time homebuyers and you will move-up people, nevertheless qualification conditions try some time more

The newest power trailing this phenomenal mortgage program took with the planning one to soldiers did not have all of that enough time preserving upwards to have an advance payment and you may settlement costs when you’re helping the nation during wartime. To address that it, the brand new Virtual assistant mortgage demands no down payment and that’s certainly one of just a couple of 100% financial support apps.

Historically, qualification to own a Virtual assistant financial has grown to add maybe not just experts of military also energetic-obligation employees having about 181 days of solution. Additionally, whoever has served for at least half a dozen many years for the National Guard or Army Reserves may also submit an application for an excellent Va financial together with us-remarried thriving spouses of them who possess passed away while serving or the consequence of a support-associated burns. Plus perhaps not demanding a deposit, new Virtual assistant home loan restrictions the kinds of settlement costs the fresh experienced are permitted to shell out.

The us government make certain on financial you to recognized the new Va house mortgage makes up the lending company to own a share of your losses. So it make certain is actually financed with what is referred to as the brand new Capital Percentage. This can be indicated since the a share of your own loan amount and you can can vary some based on the number of minutes the fresh new veteran uses this new Va mortgage to invest in property including the sort of loan. To own an initial-big date client during the South carolina with the Va loan system, the brand new resource payment are 2.15% of loan amount and that’s rolled towards the amount borrowed. Such as, a house is detailed on the market during the $225,000.

First-time people don’t need a down-payment in addition to capital commission are dos.15% of these count otherwise $4,. The fresh new capital fee is not paid of wallet but alternatively folded toward amount borrowed to have a last amount borrowed off $229,837.

USDA Rural Property Funds. That it financing program has existed for many years significantly less than personal loans online Alabama additional names however, today the usa Institution out-of Farming circumstances advice towards system. USDA Outlying Development and Va are definitely the simply $0 down financial software today.

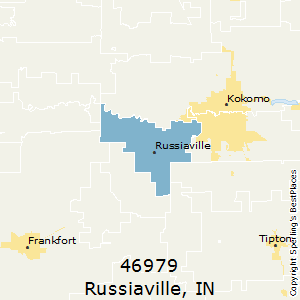

USDA rural funds are meant to assist homeowners inside the rural otherwise semi-outlying areas quicker see money also which have zero down-payment requirements. Many urban centers merely additional Charleston, Greenville, Columbia, etcetera will still be eligible. This new USDA financing are only able to be taken inside in past times recognized parts plus restricting the amount of home earnings of those not simply for the application for the loan however in the household due to the fact well.

For those who are considering a USDA financing, step one is to try to ensure that the possible home is in a medication area. Your loan administrator will help take you step-by-step through the method however, it is possible to journal onto USDA’s webpages where all you have create try enter the assets address to see if our home is actually a reasonable city.

In the event the house is from inside the a reasonable area this new consumers need next estimate household money and you will fall from the or below the restrict income constraints oriented for the area from the USDA. These types of restrictions are set within 115% of one’s median money towards area. There are alterations to that amount it is therefore not exactly 115% however your mortgage officer can identify this type of constraints to you.