What’s a keen Escrow Membership, and how Will it Performs?

Just what You’ll find out

Into the homebuying process, another transactions result as well as your new financial. Escrow methods to temporarily give those funds to a basic party to possess safekeeping. In that way, the amount of money getting such things as deposits, taxes, and you will homeowners insurance is actually kept as well as sooner repaid towards correct cluster. Let us see how they work.

What is actually an enthusiastic Escrow Membership?

Better, really there are two escrow profile. The initial happens inside the homebuying procedure and that’s handled by good closure agent otherwise payment broker. So it account handles loans just like your good-faith put (aka serious money). They truly are kept from inside the escrow to make sure group pursue done with the fresh contract. When your product sales drops compliment of as you leave, owner always reaches keep the money. But if the purchase is successful, brand new deposit would-be put on your deposit.

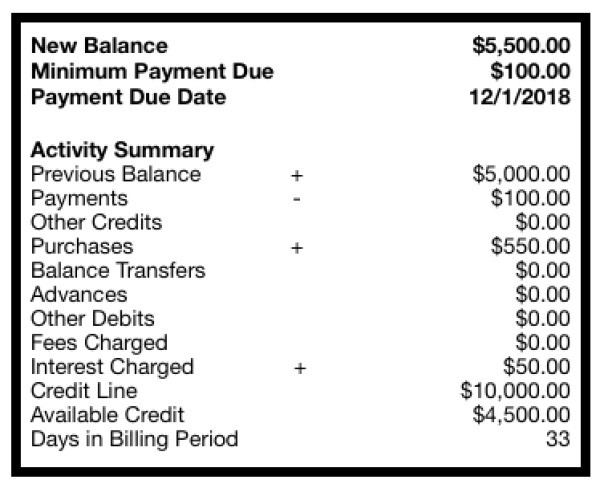

Another escrow account try managed by the mortgage servicer after your personal on the family. Which account is ongoing and you can retains loans for your possessions taxation, homeowners insurance, and personal home loan insurance (PMI) until these are generally with their particular providers. To keep them paid off, timely, such yearly swelling figures is actually separated from the twelve, which portion is included together with your month-to-month mortgage payment.

Immediately after closing, extremely financial businesses will sell your own home loan in order to another servicer, who can manage your costs throughout your loan’s identity otherwise up until its marketed once more. These types of conversion process have become common and do not apply at your loan repayments, just in which they truly are sent.

Why is that it escrow membership crucial? Basic, it has you against spending this type of wide variety when you look at the a lump sum beforehand when you purchase the house. And you can, it’s not necessary to perform all the different payment dates and you can quantity.

2nd, your own bank needs to guarantee that these types of crucial costs are formulated. Or even spend the tax bill, the Irs you will definitely in the course of time foreclose on your house, charging the lending company money. And when their homeowner’s coverage actually high tech and you may an excellent flames takes place, the damage so you can otherwise death of your house may also be costly to the financial institution.

Escrow Pillows

Your bank might require a keen escrow pillow regarding a few months just like the greeting from the condition law. Taxation and you will insurance rates can move up annually, plus the cushion covers unexpected will cost you. When your projected cushion exceeds indeed expected, the extra currency will be reimbursed for you. If you don’t have adequate currency, the new servicer tend to however advance the funds for you and you can replace the fresh membership as you continue steadily to make your month-to-month home loan money.

Await Your Annual Data

The servicer can do a yearly escrow studies to ensure you really have adequate currency to cover your will set you back. These include necessary for legislation to deliver you a letter ahead of any transform discussing their data so you can to improve the plan for increased month-to-month homeloan payment. you will have the option to invest the shortage completely if you’d like. In the meantime, keep an eye out having duplicates of your insurance and you will taxation expenses so as that people improvement in costs wouldn’t already been as the an effective wonder.

Ought i Shell out One other way?

In the long run, if you really, love handling all individual cash, possess a traditional loan, along with your loan-to-worthy of (LTV) ratio try 80% otherwise a reduced amount of brand new click this over here now home’s value, many lenders allow you to disregard escrow and spend your own taxation and you will insurance rates (constantly getting a little fee). However, Federal Property Management (FHA) and you may Department from Experts Situations (VA) loans require you to enjoys a keen escrow account fully for these types of expenditures.