Understanding the Proven Types of Earnings Whenever Bringing a mortgage

While it may be the greatest financial transaction might actually ever build, advancements during the technical have actually made it smoother than before in order to pre-meet the requirements right after which so you can commercially make an application for a mortgage. Whenever applying for a home loan, certain files such as money verification or investment verification needs (you can read this particular article to obtain the documents requisite throughout the the home financing procedure). Don’t worry, we’re going to falter which piece of the process and you will dispel the fresh misconception one delivering various types of earnings documents try complicated.

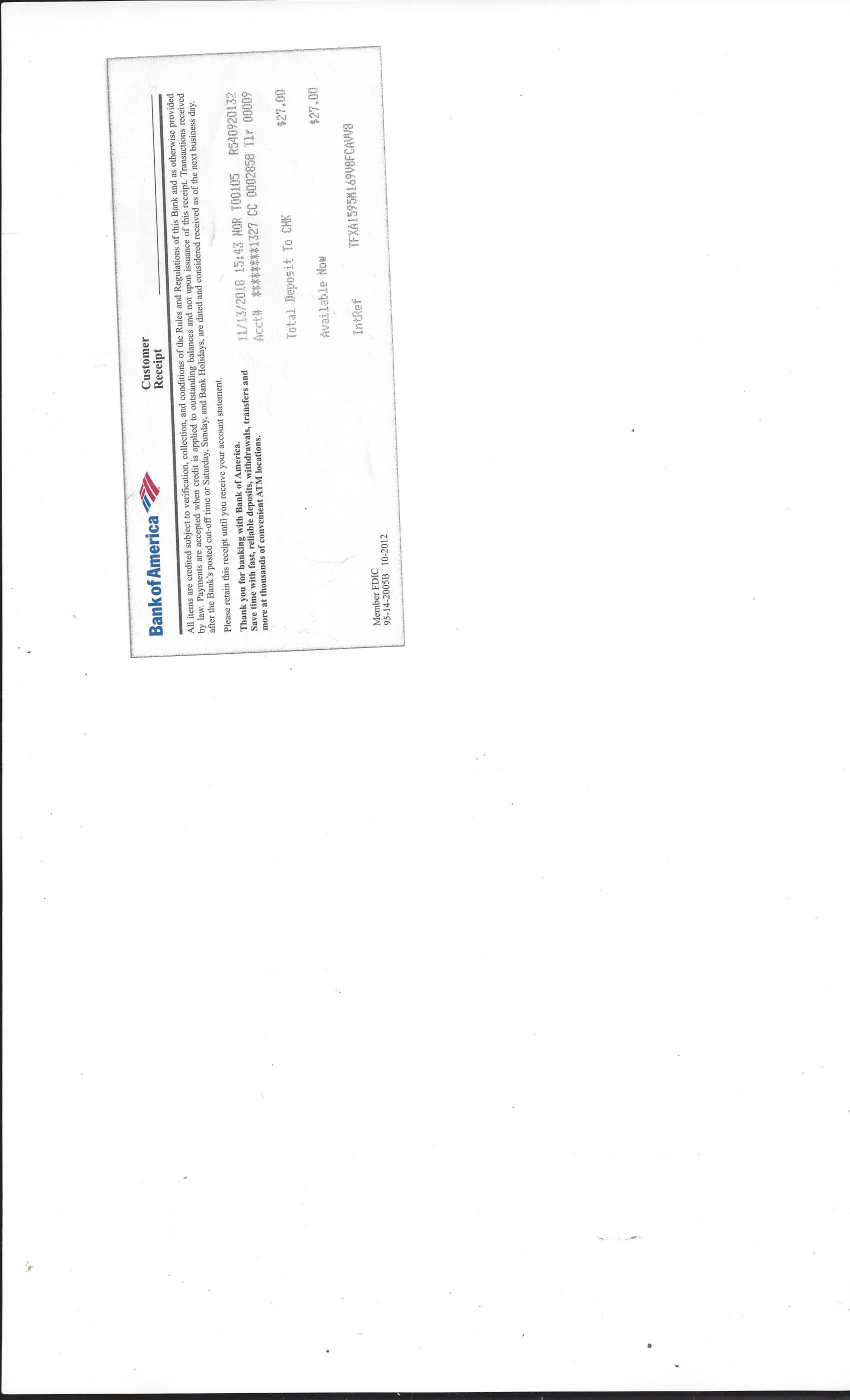

Given that a mortgage is a significant amount of cash loaned, loan providers want to make yes you can make people monthly payments and eventually pay back the loan, without the chance of shed money, standard otherwise high monetary weight with the debtor. Money verification try a standard element of which, and your bank will require the fresh new records to support it. When you’re some other loan providers might need different records, because the perform more loan items (thought FHA and you will Va streamlines if you are searching to have less docs), you can attempt the next since proven types of earnings one to will require official data:

- A job money

- Incentive, overtime and you may fee earnings

- Next work otherwise side hustle earnings

- Senior years or Societal Safeguards money

- Money spent and you will local rental earnings

- Bonus and you will attention earnings

- Child Help, Alimony/Spousal Service, or Separate Repairs Money

- International earnings

- Self-employment income

Employment Earnings

Specific individuals believe that you just bring your extremely present paystub to exhibit proof income. Actually, it’s nearly that simple; very loan personal installment loans in Delaware providers require duplicates of your own history several shell out stubs, along with your history a couple of years off W-dos statements. To one another, this type of authoritative data render an obvious picture of your general financial disease as well as the feel of your own regular earnings.

The audience is located in the new 2020’s, therefore report is out. You could bring digital duplicates of your own shell out stubs, and you can approve the lender discover your own government income tax yields right from brand new Internal revenue service, which makes it easier for you. Programs including the IRS’ Earnings Verification Share Functions ensure it is lenders to ensure the cash away from a borrower into the software procedure. Even though loan providers are seeking economic balances, this does not mean discover always difficulty when you yourself have has just changed perform if you don’t markets prior to now couple of years. In these instances, the financial institution could possibly get pose a question to your the new employer to own an evidence of income page.

Bonus, Overtime, and you will Commission Income: To help you be considered, annual incentives, overtime, otherwise income wanted a verified records and you can upcoming continuity. Fill out W-2s regarding earlier two years and you can current spend stubs. To possess tall payment income, mediocre money over 24 months out of tax returns.

Exactly what Earnings Paperwork Do I want?

Next Jobs Earnings: A secondary work or side hustle can matter in the event that maintained to possess 2 years close to much of your work, proving consistency and you may coming earnings potential.

Later years or Public Shelter Income: Pension otherwise later years income need present comments otherwise inspections verifying deposit into the membership. Verification assurances income goes on for at least three years, backed by an award page otherwise head verification.

Local rental Income out-of Investment property: Qualify that have leasing money by giving brand new federal tax come back, concentrating on Schedule E getting more money. Inform you you to- so you’re able to a couple-seasons reputation for rental income continuity.

Dividend and you can Attention Money: Loan providers guarantee bonus and you can interest money using 2 yrs from income tax yields to estimate the average. Proof asset possession expected, such as for example latest economic comments or brokerage details.

Child Help, Alimony/Spousal Assistance, or Independent Restoration Income: Validated because of the court purchases or divorce or separation decrees, showing consistent acknowledgment into past 6 months to help with home loan software.

Foreign-Won Earnings: Overseas earnings may qualify based on records on your tax returns. Operating money demands previous pay stubs as well as 2 years of income tax production, adjusting towards the brand of earnings received.

Debt-to-Money Proportion (DTI): DTI is crucial in financial qualification, determined by the breaking up complete month-to-month continual financial obligation from the month-to-month revenues. Loan providers generally prefer a good DTI out-of below thirty six%, no over twenty-eight% allocated to home loan repayments. However, DTI conditions differ by bank and you can mortgage particular.

Mortgage Earnings Calculator Positives: Making use of home financing Income Calculator support determine cost according to specific money sources. AmeriSave even offers a home Affordability Calculator having quoting financial affordability using most recent earnings and loans repayments.

Conclusion: Get ready money documentation very carefully and talk to an AmeriSave mortgage banker to help you line up which have bank requirements. So it assurances a smoother mortgage software techniques than simply expected.