One step-by-Action Guide to the new FHA Loan application

- Regarding the FHA Loans

- Standards

- Cost

- Ideas on how to Pertain

- Design Funds

- Condominium Acceptance

- Are formulated Mobile

- Energy saving Mortgage

- FHA 203K Financing

FHA financing allow borrowers to purchase a house without necessity for a massive advance payment or a leading credit history.

This type of money try backed by the Federal Houses Management, an agency that works under the Department from Homes and you can Urban Creativity. By the FHA ensure, lenders exactly who question these types of funding are secure for many who standard on your loan. This is why, they may be even more lenient towards criteria to apply for a mortgage.

This is going to make FHA funds a well-known choice for first-day people and the ones whoever borrowing or cash make it difficult so you’re able to be eligible for a traditional mortgage.

1: Look FHA Mortgage Conditions

In advance of plunge into the app, you will need to determine if you are an effective applicant getting an FHA mortgage. FHA fund enjoys certain requirements, together with credit ratings, off payments and you can financial obligation-to-earnings ratios.

Basically, you will need a credit rating out-of 580 or more to own a great step three.5% down-payment. If the get try anywhere between five-hundred and you can 579, you may still meet the requirements, but you will you desire a great ten% advance payment. Studying these standards early assist you to discover if the a keen FHA mortgage matches your position.

Step 2: Contact FHA-Approved Loan providers

Its not all financial has the benefit of FHA funds, therefore you’ll want to find one one really does. Select FHA-approved lenders in your area and come up with first contact. More bad credit personal loans in North Carolina finance companies and you may mortgage companies render such financing, which really should not be nuclear physics to obtain a being qualified bank.

This action allows you to make inquiries, know specific app techniques, and begin strengthening a love with each lender. Other lenders you’ll offer somewhat some other cost and you can terms and conditions, therefore don’t hesitate to look around.

Step three: Gather Necessary Files

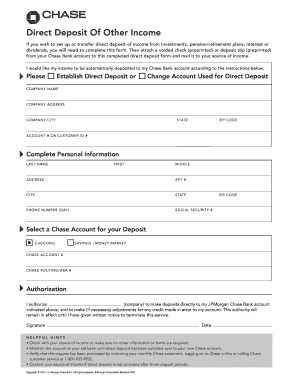

After you’ve chosen a lender, start gathering the required files to suit your application. It normally is sold with evidence of money, a job history, personal personality, and you can information about people expenses and assets.

That have these data in a position increases the process and you may shows the severity and you may company into the financial. In place of this documents, the lender you should never proceed along with your application, thus that have it waiting reduces prospective delays.

Step four: Done FHA Application for the loan

The next step in the process is always to complete an effective Uniform Home-based Loan application, labeled as this new Fannie mae Form 1003, to apply for an FHA mortgage.

Within this mode, you ought to supply the property target and kind of mortgage your need, as well as details about continual expense, income supply, earnings wide variety, property expenses, and you will earlier in the day/latest work. Before you could complete the job, you’ll accept a credit check, so that your lender can be evaluate debt record.

Up to now, it’s also possible to have to pay a payment for the borrowed funds software. If not, it will be included in the closing costs. So it may vary round the lenders, so be sure to consider their policy.

Action 5: Compare Loan Estimates

Just after using, loan providers will provide you with a loan estimate (LE). LEs are made to make mortgage process transparent. Which file outlines the expenses of the the loan, including the interest, monthly premiums, and you can settlement costs.

You are getting financing rates from each financial you applied having, providing the chance to compare and get an educated offer. Think about, a decreased price isn’t really constantly the top when the you’ll find significantly highest charge.

How to get The FHA Loan application Recognized

Having your FHA application for the loan recognized is the 2nd larger action immediately following using. Acceptance means you are one step nearer to having your dream domestic.

The length of time can it decide to try get a keen FHA loan?

Enough time it will require to apply for a keen FHA financing is differ significantly according to multiple facts, such as the difficulty of finances, the brand new completeness of the app, plus lender’s running timesmunicate regularly along with your financial and you can act rapidly to your asks for pointers otherwise files to be sure an excellent smoother, less process.