Listed here are some of the other financial tool choices to imagine

Home loan Facts

You can find some other mortgage unit to consider when searching for deciding to make the ultimate decision for your finance and you can based your situations you have an incredible importance of one to variety of of device over additional.

Idea and you will focus funds

Principle and interest mortgage repayments mean you are going to pay back the fresh concept (the actual financing equilibrium) therefore the notice number appropriate with the concept. With this particular version of home loan you will gradually reduce the dominant (balance) of your own loan.

Concept and you will appeal may be described as P&We repayments and also the repayment count exceeds repaying interest merely money. Current lending plan additionally the bodies of the financial go for P&I payments into the lenders to be able to eliminate all of our federal personal debt through the years.

With respect to the anybody issues, they could only want P&We repayments or even for certain facts they may wanted desire simply money. These scenarios are considered lower than.

Interest just money

Focus simply payments do not reduce the principal (loan equilibrium) through the years, they simply spend the money for focus computed towards the harmony of your own mortgage. Hence interest merely payments are lower than P&We.

Desire just (IO) repayments could be liked by buyers who would like to lose outgoings (will cost you to hold the new advantage) whenever you. This strategy will assist to create extra dollars for further resource instructions.

IO money are typical whenever trying to get a construction financing because the loan providers just remember that , while in the design, its good for eliminate outgoings plus don’t necessarily wanted idea to get paid off during this https://paydayloansconnecticut.com/lakes-east/ period.

IO money can also be prominent if you have a short term reduced family money, like pregnancy log off.

There can be a number of other practical criteria getting IO repayments not here fundamentally needs to be a suitable explanation for an IO consult.

Changeable interest levels

Changeable form the pace goes down and up given that whenever loan providers disperse its cost. You will find pros and cons so you’re able to variable cost only on account of the truth that when the prices go-down, you pay shorter appeal, if the costs go up, you only pay even more.

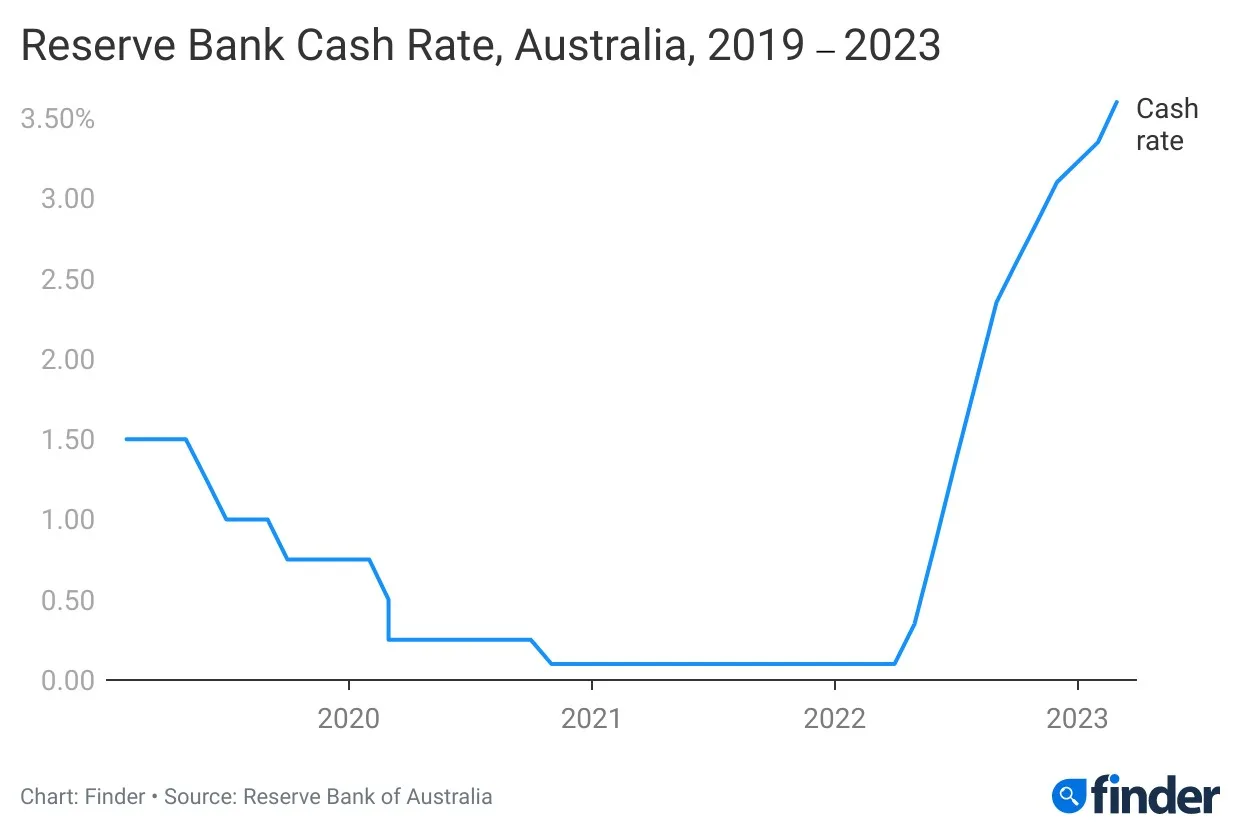

Such as in case your Royal Financial of Australian continent (RBA) advances the cash speed, lenders will most likely increase their costs. There are some other reasons for rate of interest course however the point is you do not have control over new movement of the speed.

To emphasise this, if you have $step one,000,000 owing to the financial institution and you will interest rates go up of the 1 / 2 of a percentage (0.50%), meaning you may have a separate $5,000 of interest costs and then make a-year, and that’s extreme dependent on your needs. If this goes the other method (0.50% less), after that pleased months, you may have some extra saving to help you tuck away.

Fixed title rates of interest

Repaired name rates of interest mean you decide to fix the pace having a time. Essentially that is 1-5yrs fixed and perhaps it could be longer.

Fixed label interest levels is a or crappy choice dependent on when you boost your own rates and you can what will happen to your ple for those who augment within really low rates of interest, considering the newest rates goes up in the future, plus they carry out increase, then chances are you generated a great choice. However, if your enhance and pricing go-down, then you’re expenses higher rates for the rest of the fresh fixed name of loan.

There are terms and conditions info for the repaired title attention pricing eg crack costs and you can speed lock alternatives which you is to consult the mortgage brokers to make sure you have got a good complete comprehension of before selecting the merchandise alternative.

To help you book a scheduled appointment, check out the e mail us webpage, finish the means and we will deliver an invite to satisfy and you may explore entirely outline most of the over.