Whats the essential difference between rate of interest and you can Apr?

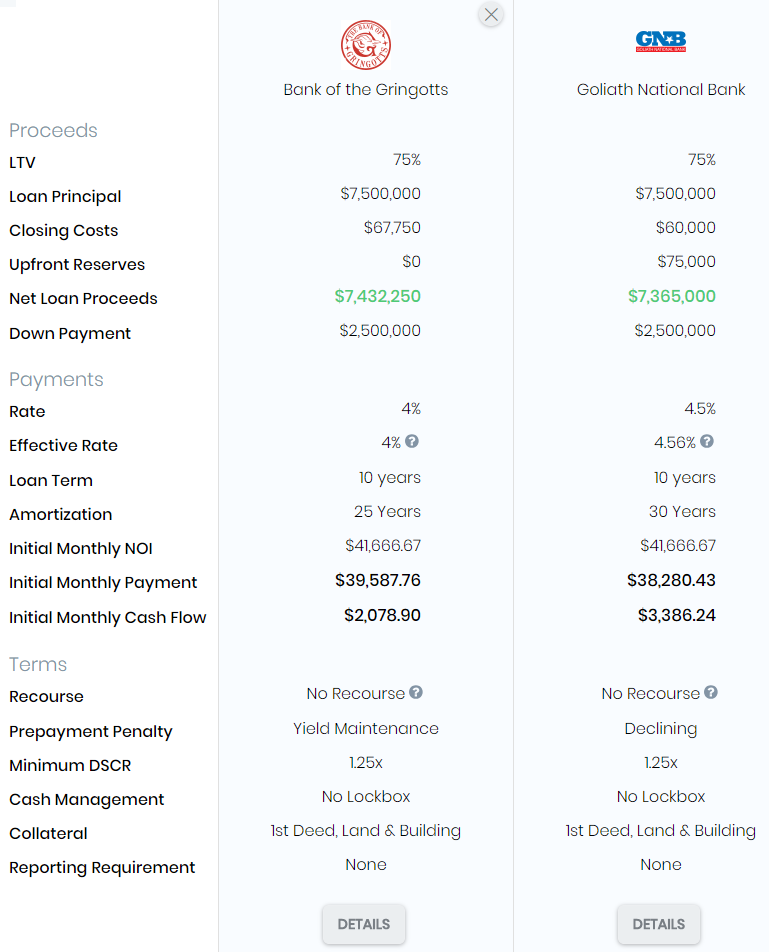

When trying to track down a mortgage, you’ll get a few important proportions regarding the Financing Guess – rate of interest and you can apr (APR). Each other can be quite useful to assist determine which mortgage are most effective for you. Exactly what are they? Just how do they differ? And just how can you use these to contrast? Let us break every thing off.

What is rates of interest?

Every month you only pay your own homeloan payment, you may be generally using area of the principal (the fresh new borrowed count) as well as appeal.

Interest rate (labeled as the notice price) will say to you how much cash desire it is possible to spend every year, and assists your calculate the month-to-month mortgage repayment. Interest rate is set away from individuals affairs, particularly market standards, credit rating, deposit, mortgage particular and you will label, loan amount, brand new home’s location, in addition to particular rate of interest (fixed or changeable).

Usually do not guess a specific financial deliver a far greater mortgage only once the interest is gloomier. There may be even more charge from the loan, that is in which annual percentage rate (APR) will come during the helpful.

What’s annual percentage rate (APR)?

It assists you are sure that this new lose ranging from rate of interest and you can more costs. Because of other costs provided, the Apr exceeds their interest rate, plus its indicated once the a share.

Once you have taken out the financial and now have good ratified offer with a home target, your own financial must give that loan Estimate in this three working days. Loan providers are needed by-law to disclose both the rate of interest in addition to Apr.

You should use brand new contrasting element of the loan Guess so you can get a sense of just how their loan’s Apr gets up against funds off their loan providers.

Why do we truly need one another?

The key difference in the two is that your interest assists imagine what your monthly payment might possibly be. On the other hand, Annual percentage rate computes the full price of the loan. Therefore, having fun with both makes it possible to make an excellent truer loan analysis.

Apr is particularly of good use if you plan for the looking after your loan for many of one’s loan’s term, 15 years otherwise three decades like. Once the Apr boasts the entire costs along the lifetime of the latest financing, you may work on which fee as it’s the brand new truest sign away from over, long-term can cost you.

If you are interested in determining your own monthly payment, interest rate is likely what you should work on. Merely do not forget to include people taxation, insurance policies, and you can home loan insurance when calculating the monthly payment.

What are the limitations out of Annual percentage rate?

It also assumes you are able to maintain your financing because of its whole title, which doesn’t takes place that frequently; most people commonly flow or refinance will ultimately. When you find yourself getting a variable-price financial, you should also note that Annual percentage rate will not echo maximum notice rates of one’s loan, thus be cautious while using the Apr due to the fact an evaluation unit.

Exactly what otherwise any time you believe?

When you are Apr was a great truer price of the borrowed funds, just remember that , all those costs will most likely not it’s be paid from you. Let’s recommend you’re taking out a good Virtual assistant mortgage, and you discussed to own as much as $ten,000 of one’s closing costs protected by owner. Their Apr may be very high, but rationally, the seller was investing in a chunk of these will cost you, such as your settlement costs, origination fee, and you may dismiss activities. Very don’t get scared out-of from the an apr unless you it’s know what you are using. Rate of interest and you $255 payday loans online same day New York may Annual percentage rate should be challenging, so make sure you ask your mortgage banker for those who have questions.