For the majority borrowers, student loan debt are going to be a burden so you’re able to homeownership

Having outsize loan balance can raise borrowers’ personal debt-to-income (DTI) ratios-and therefore most lenders thought to get a significant indicator away from borrower creditworthiness in their underwriting decisions-and steer clear of all of them off saving money. As well as for consumers that have defaulted on the figuratively speaking, the newest struck on the credit history makes them ineligible getting a mortgage.

The fresh new Biden management has just established its suggestion to possess scholar debt relief, that has $10,000 out-of mortgage forgiveness for the majority of consumers having as much as $20,000 regarding forgiveness getting Pell grant readers, an even more good-sized earnings-inspired repayment (IDR) plan, and an extension of your commission stop from stop out-of the season. The brand new administration and put-out the facts of their Fresh Initiate initiative, that can create defaulted consumers to go back to help you a recently available standing when education loan money resume.

This type of recommended coverage alter you certainly will speed up the way to homeownership for some education loan borrowers-particularly individuals out-of color-by the lowering the DTI ratios, allowing them to rescue a whole lot more to own down costs, and you can boosting its borrowing histories.

Quicker personal debt-to-money rates

Currently, this new median the student loan loans is mostly about $20,000, definition many borrowers are certain to get their entire balance forgiven. Having a debtor paying off a great $20,000 mortgage that has their whole balance forgiven, monthly payments create shed regarding more $two hundred in order to $0. However, also one particular with extreme a great college student obligations, requested monthly obligations usually decline. This means that, of numerous homes with pupil financial obligation will discover its DTI ratios slip.

DTIs are determined because extreme month-to-month expenditures, in addition to people education loan repayments, split by the disgusting month-to-month money. The important loss in otherwise removal of monthly student loan expenditures could circulate properties into americash loans Paxton margins out of homeownership readiness for the an excellent DTI proportion within or less than forty five %, the standard limit used by Fannie mae in underwriting means.

The fresh IDR offer will have effects to have DTI percentages just like the well. When accompanied, the plan do drastically eradicate monthly premiums to possess education loan borrowers. Last year, the fresh new Government Houses Administration upgraded their information to possess figuring education loan monthly obligations when a debtor is utilizing IDR very this type of calculations will be way more reflective of your own borrower’s actual monthly payment. This is why, the fresh reduced monthly premiums beneath the the latest IDR offer usually also connect with DTI ratios to make it easier for certain individuals in order to be eligible for a mortgage.

A current bachelor’s education graduate, including, makes money as little as $20 beneath the the fresh IDR proposition, down from $115 according to the really good most recent IDR plan. For even borrowers who does already be eligible for a home loan, a reduction in obligations on the size you may permit them to purchase a home from nearly $20,000 large value.

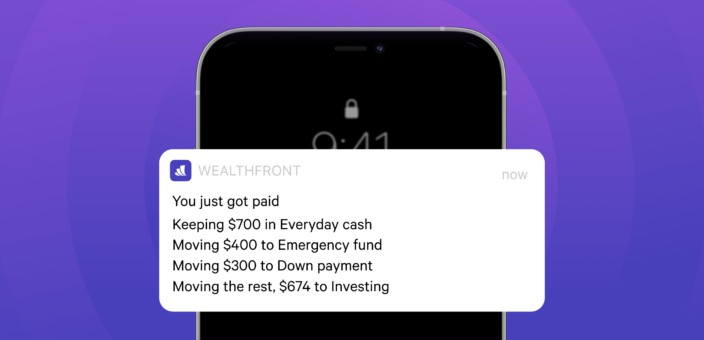

Increased savings

Education loan consumers have benefited out-of over a couple of years regarding paused government mortgage repayments, however now all these consumers can remain to keep what they might have otherwise spent on education loan costs because fee stop ends up. The extra offers could enable it to be borrowers to accumulate a downpayment more easily, quickening their path to homeownership or permitting them to buy a higher-priced household.

The fresh IDR proposal’s losing monthly payments may also assist consumers cut in the event the entire equilibrium isn’t destroyed. Even if they will certainly be to make payments, of numerous individuals pays a much reduced express of their discretionary money than just they were before COVID-19 pandemic.

Enhanced credit histories

When education loan payments resume for the January, individuals in standard will get the chance to go on to an excellent latest repayment status with the negative effects of defaulting removed from their borrowing records. Student loan standard in addition to delinquencies leading up to a default can cause a fall for the a borrower’s credit history out of upwards to help you ninety situations. Having such delinquencies and you may default erased using their borrowing from the bank records you will definitely help specific student loan borrowers’ credit ratings rebound sufficient to visited a rating who would make sure they are eligible for a home loan.