This is basically the lowest credit rating you should get good home loan

In contrast to whatever you hear otherwise see, the credit shouldn’t have to getting excellent to obtain an effective home loan. Very banks and loan providers need at least a good 640 credit score. not, not all the loan providers are made just as. Some tips about what you have to know while looking to to track down a home loan with poor credit.

For Old-fashioned Mortgage loans you usually you need about a great 620 credit score

Lenders will likely check your credit history out of for every single bureau. They use the center rating regarding about three and rehearse that since choosing rating.

Its practical to assume you are ineligible for it form of out of that loan whether your credit history try around 640

For FHA Mortgage loans particular loan providers go only 600, some whilst low while the 580, in just step three.5% for the security. Brand new wonders credit score must get home financing, yet not, isnt 580. Shockingly sufficient you can buy home financing to get, if you don’t do a money-Away Re-finance, that have a credit score as little as 550. However, there was a catch. One to hook is that you you prefer at the least a great ten% equity updates. It means you prefer ten% off when purchasing a house or 10% security whenever refinancing. Not absolutely all lenders fully grasp this capabilities and has accomplish with regards to tolerance to possess chance. The greater exposure a financial is prepared to undertake, the greater the probability are to get approved. Here’s what you should know. The process getting a home loan that have a credit history less than 600 is not going to be simple. It’s going to be challenging and it is browsing involve thorough causes of credit history.

Rebuilding borrowing from the bank If you are looking to boost your credit score to own an easier big date to the procedure, everything getting equal, your credit score would obviously have be well in excess of 620. This would prevent they away from checking out the exact same particular analysis you if not perform go through from inside the a lowered tier borrowing rating bracket.

Down payment Recommendations This is an eligible system one typically demands an effective 640 credit score. We provide that it across-the-board with many banking institutions and you can lenders.

Previous quick selling, bankruptcy proceeding otherwise property foreclosure These materials will nevertheless hold a comparable waiting date, that is three years into a foreclosure and you will an initial marketing. The waiting time towards a bankruptcy is actually a couple of years. After such cycles, you are qualified along with your credit history doesn’t always have hit.

Highest debt-to-income rations It is no miracle FHA fund also allow it to be payday loans Providence loans-to-money ratios more than 54%. To be entitled to that sort of financial support, the credit rating shall be in the community regarding 640 otherwise large. This isn’t to state that in the event the credit score is 620, instance, it doesn’t work. not, it is becoming a make certain that if for example the credit score is actually below 600 you will enjoys a hard time taking that loan recognized having a financial obligation-to-income proportion exceeding 45%.

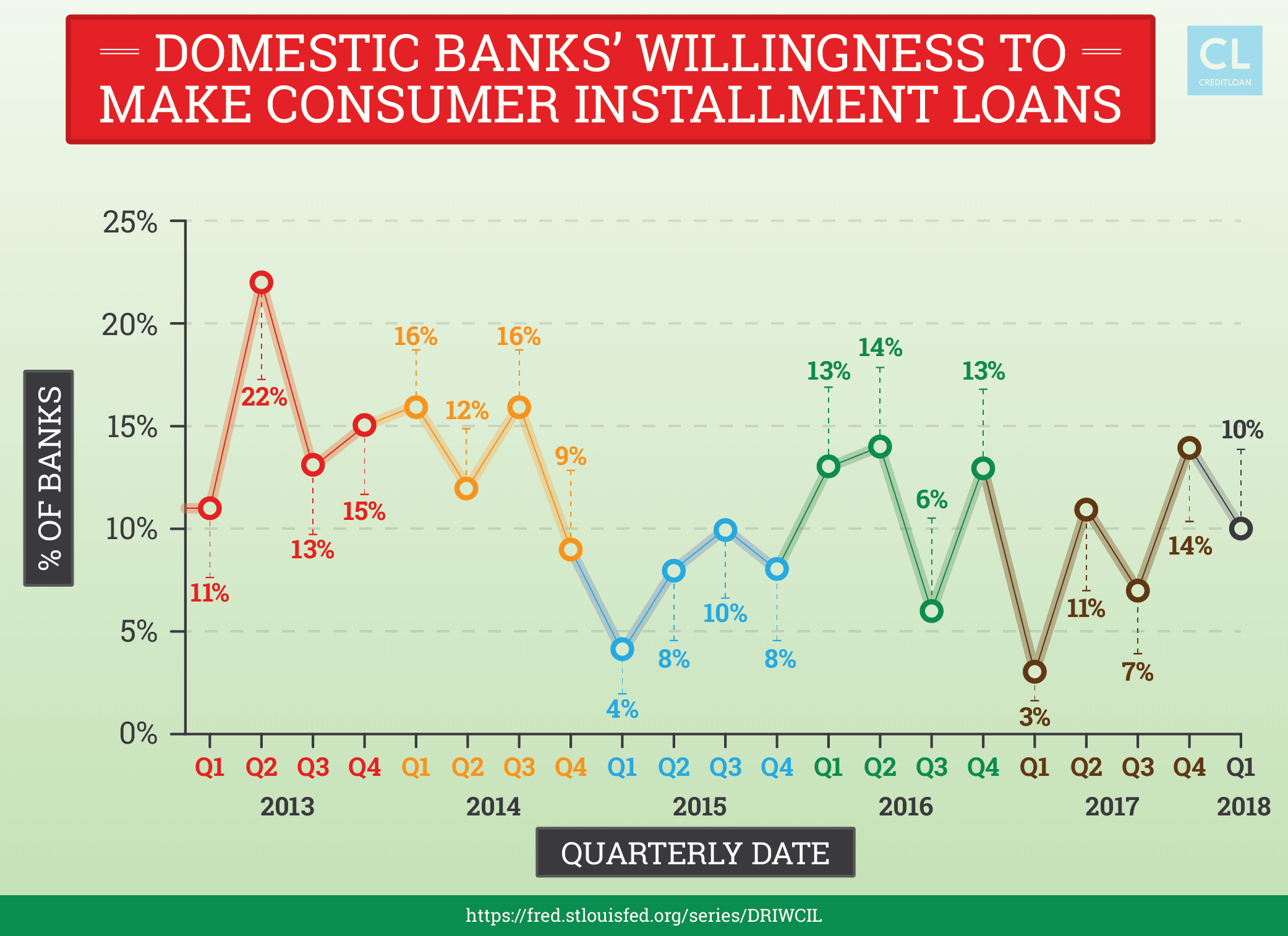

Pay personal debt in order to be considered This really is a huge one to. Paying loans in order to qualify is a little identified secret inside the fresh new lending community you could utilize in your favor. Particularly: Can be done a cash-Aside Re-finance with your domestic. This will enables you to pay-off installment fund and you can borrowing from the bank notes, which in turn carry a somewhat high rate interesting than just about any home loan. Wrapping all of them to your fee do rather save some costs and you may its an alternative that have straight down credit scores.

If you have been turned down getting home financing on account of your credit score not being adequate, otherwise the debt-to-income proportion are too much, score an extra, maybe even a third thoughts. If the somebody was suggesting this may help you, its worth every penny to carry on your hunt to acquire an effective a great lender. One which understands how-to make a good loan and you will usually strive to you personally.