The very last thing yet another customized resident wants is to be saddled that have an extended-label financing which makes lives more difficult

As the our company is seeing, the aforementioned points always pertain alot more so you’re able to federal finance companies. Local banking institutions are a tad bit more versatile and might even offer mortgage programs certain so you can barndominium structure when there is been adequate of it in your area.

Sooner, a financial of every dimensions are in search of a loan they can feel confident in and also make getting a project that suits in this antique direction and you will could have a sellable mortgage one to aids the residence’s really worth.

Third-Cluster Lenders

This package is much like a lender and you will nearly an identical since it is in more antique designs of bespoke home construction. Yet not, there are many recognized variations.

Generally, a 3p lender’s finance proceed with the exact same design just like the men and women of a vintage bank you’re getting a casing financing which is transformed into a home loan on the end of your panels.

But because they focus on pole barn building resource, there is certainly fewer hoops since the lender understands exactly how barndos are created as well as discover they require comps that will be individualized this new framework to your slab otherwise crawlspace-they are not limiting comparables to many other recently developed barndos hence is more complicated to acquire, for example according to market in which one is building.

Just like contrasting a beneficial bank’s design money, it is important to spend your time taking a look at the brand new small print from a 3rd-group lender’s money.

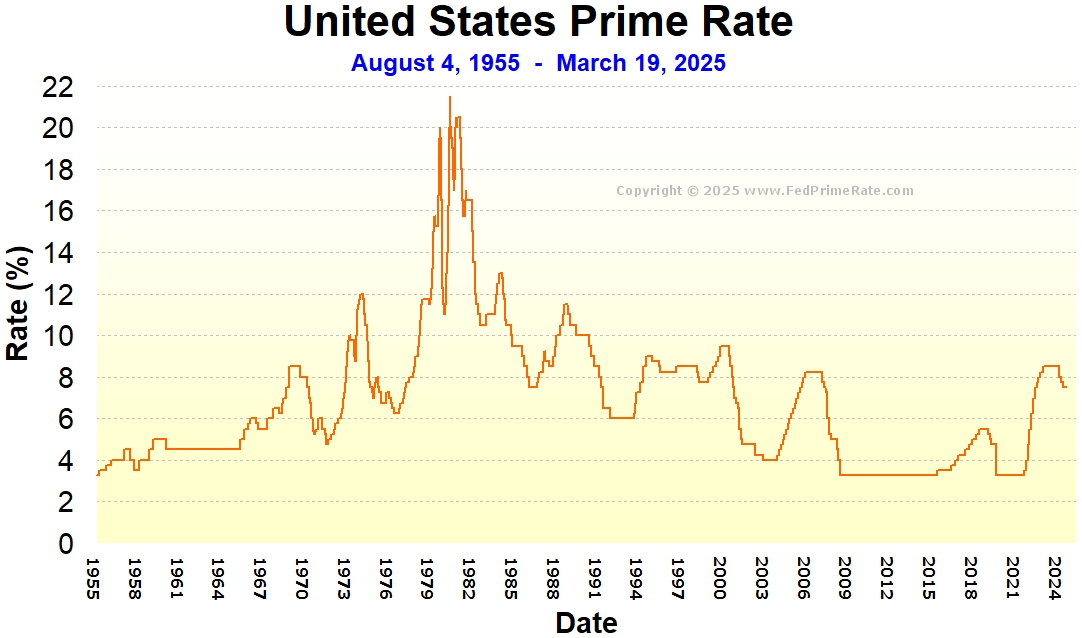

Possible Factors: One of the greatest disadvantages to this investment route are rates of interest (we all know, they have been anything all upcoming people was fighting which have).

While you are a good 3p lender is friendly to share frame house design tactics, their interest rates might not be because friendly on the bag.

Additionally, it is best that you save money time looking at new terms and conditions and you may standards of the financing as possible significantly distinct from a bank. As an example, a beneficial 3p may have a smaller payment title otherwise want an adjustable-rate financial.

Barndominium Capital: Exploring the Options available

To make sure, there are lots of banking institutions and you will third-people lenders out there which can be well worth thinking about because prospective financing offer to suit your investment.

Strategies for Funding Your Barndo Enterprise

No matter which barndominium money option you select, there are several best practices all the coming resident want to make area of their research stage:

- Influence Your finances: Whilst it will be wonderful to possess a task in which money don’t count, that is not a reality into bulk of individuals. Its really worth using a few momemts researching assembling your shed and you will your own wants and needs against what you could relatively accept since the an extended-title bills.

- Ask The questions Need: There is no guilt in the doing all your homework to ensure you’re going to get financing you could accept. Funding good barndo are a major financial support and you have all the directly to enter into you to an element of the project which have vision wide-open.

- Documentation: Get ready that have detail by detail agreements and you can loans Denver CO prices into the design otherwise recovery. Lenders may wish to note that your panels is actually viable and well-planned. If the hardly anything else, getting the records under control makes for way more expedient product reviews.

- Shop around: Given that money possibilities can vary generally, it is very important comparison shop and you can compare also provides off multiple lenders. The very last thing need is to be stuck with a home loan for some many years that may was in fact best had your done a bit more research.

- Demand Advantages: Believe seeing a large financial company or other knowledgeable financial whom provides dealt with resource non-traditional structure systems. They may be able assist you to best lenders that assist browse the credit procedure.