Spanish Mortgage loans for Non People inside the 2024

Spanish Mortgage loans otherwise home loans could be the financial otherwise banking equipment to which an average saver spends by far the most currency. Taking a home loan to find property during the The country of spain is something very common one of expats who’re looking to move to Spain. If you’re hoping to get an interest rate during the 2024, you need to carefully check this out guide, to see home financing package that meets your position. All of our recommendation is that you devote some time to understand what a home loan try as well as how it really works, so you can get a knowledgeable choice.

Should i score a home loan inside The country of spain because a non-resident?

Low Foreign language Citizens buying property within the The country of spain are certain to get no problem acquiring good Language financial. Keep in mind that low-Eu individuals can get deal with more requirements than simply European union nationals, hence expatriates interested in a Foreign language home loan carry out tend to face large prices and less money.

Non resident Language Mortgages rates

While you are financial rates of interest for Spanish customers reaches historical lows with lots of new mortgage loans which have rates of just one% or quicker, non-citizen foreign-language mortgage loans are at the mercy of rates off on minimum 2-dos.5%. Non-resident mortgage loans inside The country of spain are normally repaired rates and have a beneficial term of only about twenty years.

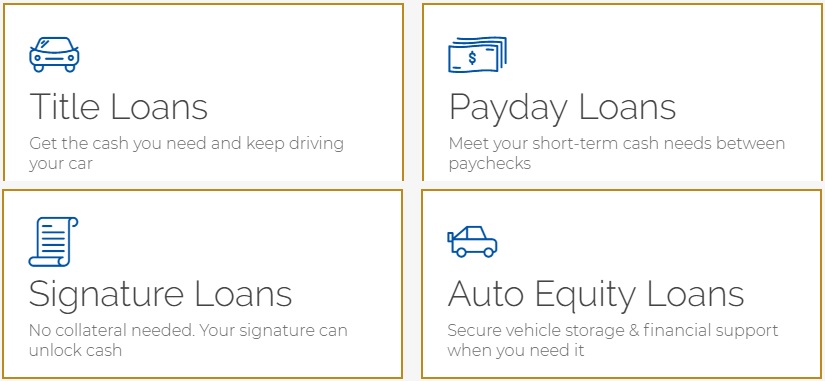

Variety of Spanish mortgages

Spain gives the typical brand of language mortgage loans, with expat-focused Language mortgage loans provided by all over the world finance companies and you may Language banks. Many Foreign language mortgages haven’t any limits for the price or nationality, however some circumstances like customers off certain places, or to shop for possessions in certain places. But, exactly what are the typical mortgage models?

Non-Citizen versus. Resident Foreign language Mortgage loans

The biggest difference in domestic and you will non-domestic finance is the limitation financing-to-worthy of (LTV) one to banking companies allows. Citizens can be essentially use doing 80% of property’s examined value whereas low-citizens was limited to 6070% LTV, according to the financial method of. The good news is that it tends to be you can easily so you can use more of your own property’s value up to 100% sometimes when buying an effective bank’s repossessed property inside The country of spain.Specific financial institutions might only become happy to promote a mortgage to overseas consumers for their very own a house postings. In this situation, the options to get home financing may be closely associated with a particular assets. Occasionally, the borrowed funds you get is generally in accordance with the financial assessor’s valuation of the house rather than the rate you may be spending money on they. Thus, if the a keen assessor valued your property within 125,000, you could potentially traditionally borrow doing 87,five-hundred, even though your purchase rates was only 100,000.

Bringing home financing while the Retiree from inside the The country of spain

If you’re looking in order to retire inside Spain, and are usually over age sixty, you could have a mortgage providing you come in receipt out of a retirement. When making an application for a great retiree financial, you could potentially designate a beneficial guarantor particularly a family member to contain the credit. Like that, you might be in a position to make use of specific income tax pros americash loans Stafford Springs, should your stated guarantor is additionally area-owner of the home.

If you are starting a corporate when you look at the Spain, your ple. In such a case, you could money disregard the by making use of so you’re able to a commercial spanish mortgages. With respect to commercial money, the prerequisites was slightly distinct from common. In such a case, the lending company or the loan providers, often charge a fee every files about the company you should work at. Which means you must establish your organization preparations, is the reason any early in the day companies and have demostrated past experiencemercial fund normally be used to fund a total of 50% of your speed or valuation of your organization you need to pick.