You are going to each other become liable for the mortgage up to it is paid

In summary, you could potentially separate possession of the house which have tenancy in accordance or any other proportion, but We don’t thought you certainly can do that with the borrowed funds.

This. We put off so you can Terry’s degree, however, I don’t know just what he function over when he says “often is achievable”, just like the AFAIK the financial institution tend to, due to the fact pgdownload said, hold both sides “as one and you will severally loan places Topstone liable”.

My wife and i got aside one or two money as soon as we bought their unique household to each other, i for every lent more quantity and put in numerous amounts of bucks, and each people took obligations to have costs to your “our” financing. However, we were never ever below any impression that we just weren’t together in charge on the vision of the bank.

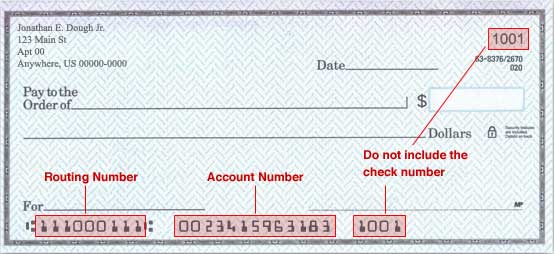

If we score that loan off 300k since shared tenants, will we have it separated it is therefore clear she owes 150k and i owe 150k otherwise would the mortgage you should be lower than the one organization because two?

For this reason, starting which strategy (that have split financing etcetera) contained in this sorta problem wouldn’t be a wise circulate

Score a few financing (titled a split) and its own your own contract among them of you whom possesses each financing.

Into the OP’s instance, because of the moving in and you may continuing to invest in a home together, will that qualify given that de facto relationship?

My personal earliest wisdom is functions into the de- facto relationship feel the exact same liberties since a married couple. Thus, in the event of a torn, perform the activities feel the liberties to a fair split up of asset?

I’m not sure with the what is the web value of OP and his partner, but helping more a decade without any house to name you will indicate a negative economic administration.

When you look at the OP’s instance, by relocating and continuing purchasing a home to each other, tend to you to definitely meet the requirements while the de facto relationships?

every one of you will has actually a state they 50 % of brand new resource well worth no matter just who shared just what.

50 % of isnt automated therefore the final number simply end up being dependent on a courtroom when you look at the judge otherwise earlier agreement involving the a few events.

An even more accurate statement will be “every one of you may keeps a state they element of the resource really worth”

For the OP’s case, of the transferring and you can proceeding purchasing a property to one another, have a tendency to one qualify given that de- facto matchmaking?

Sure, somebody offer both season draw because the a choosing foundation however, that is because the legal can not build orders changing possessions passions until new specifications out of s90SB of your Household members Rules Operate is met. That’s where the two 12 months period of time arises from however, it may be below one to around certain factors including with an infant to one another or if your finances was intermingled into the quantity of shopping for a home to each other. Actually that have a home ownership design off Clients in accordance that have different proportions wouldn’t very offer far otherwise one security facing a great judge judgment that’s other.

My earliest understanding are parties inside de facto dating have the same liberties since a married pair. Hence, if there is a split, carry out the newest events have the legal rights to a good split from advantage?

I don’t know towards the what’s the web value of OP with his other half, but working for over ten years without having any house to identity you will mean an awful monetary management.

(Colloquially also known as a good pre nup otherwise pre nuptial arrangement. There are models on the available for defactos as well.) A great BFA wouldn’t give sheer cover while the something is challengeable in courtroom, particularly if the BFA within the naturally unjust for starters class, however it does offer a safety net because the people can get to invest through the nostrils inside the lawyers costs to help you issue they.

Just how can EazyBankLoan direct you towards providing that loan? We know the process of procuring that loan will be tiring. For this reason i take care of your loan app process, saving you time and stress because of the dealing with files and you can communications towards the loan providers.

All this need, $$$ inside court processes. On top of that if there is a clause throughout the present Financing that speak about punishment off very early settle, extra money to pay.

Furthermore and if the name’s from the assets, you also try not to force offer if you do not individual the latest majority share. Your partner provides a straight to veto your push selling.(because he along with owns fifty%). Overall, TS try a beneficial sucker and you’ve got no possibilities however, in order to Convince politely your pal to release your title about financing contract from the asking your own friend so you’re able to re-finance the loan.

Very difficult to state fair or perhaps not. If you even while got stay here, must you back go out new leasing to own him? Jus a good example though.

When we get that loan out-of 300k since joint renters, do we have it split up it is therefore obvious she owes 150k and i owe 150k otherwise would the loan just be less than the main one entity as a couple?