As with any version of financing, build finance has actually positives and negatives

Build Financing Requirements

Domestic build finance are generally felt riskier getting lenders, which means that discover stricter criteria to acquire a beneficial construction financing more than other types of loans. To qualify for a houses loan, you have a leading credit score and you will a great personal debt-to-money ratio, which is the proportion of one’s month-to-month recurring loans towards the gross monthly earnings. Its also wise to possess spared a downpayment of about 20% of your total price. For many who already own the home, you need the latest guarantee on the homes since the downpayment rather.

Within your acceptance procedure, your own financial might have to accept the brand new builder you have selected and make sure they are certified and you may covered. This will help include the lender’s money and facilitate cover you through sure you reside are dependent by the a beneficial creator that is legitimate and dependable.

Your lender might must review their arrange for structure so they are able agree they and make sure loans Paragon Estates design are staying on track on build. Starting a housing plan helps ensure that everybody involved in the construction procedure understands brand new project’s asked schedule and that you tend to getting told if you can find people delays otherwise transform for the asked framework plan.

Positives and negatives out-of Structure Financing

With regards to the specifics of your unique things, a casing financing may be the best financing choice for you right now.

Construction money generally speaking start with a great twelve month terminology so that you can have a bit of wiggle room to regulate getting weather, have or other delays. Yet not, if you want to to alter it, it’s easy to would. This can be helpful since if you will find unanticipated delays that are from the along with your builder’s control.

Loan providers always provide advice with framework financing included in the framework plan. While this can be an extra action you must capture getting acknowledged, adopting the these tips helps you ensure that your project remains on finances and on agenda.

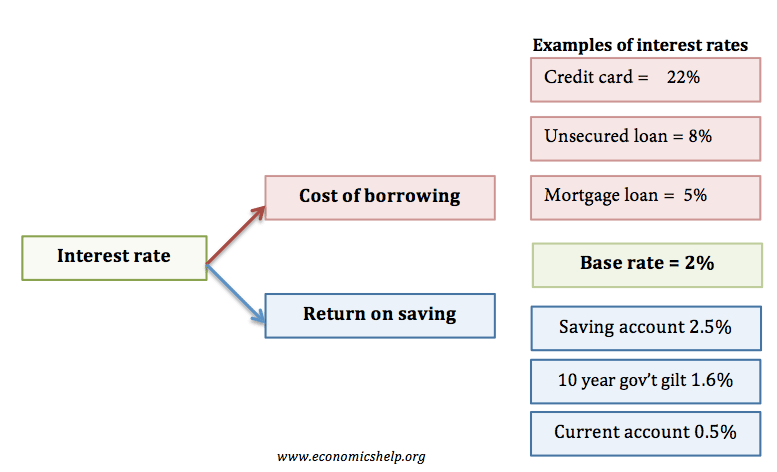

Since they’re said to be riskier by loan providers and are also unsecured until the house is built, structure financing often has actually highest rates than other kind of loans. Arkansas Federal also offers structure financing which have competitive, repaired rates of interest.

The risk associated with the framework financing entails they can become more difficult to qualify for. A housing loan may require one to fulfill higher requirements during the acquisition so you can be considered than other loan types.

Apply for a casing Loan Today

A housing loan should be a good funding option for anyone that is seeking build a home. Playing with that loan intended for build can help the build sit on the right track which help your stick to most readily useful of all the will cost you linked to building your house.

Arkansas Government also provides fixed-price structure financing with competitive interest rates. You can use our free financial calculator to obtain an offer of one’s mortgage payments.

There isn’t any cost to apply. You can implement online right now to protect their interest rate for ninety days. When you yourself have almost every other questions relating to build financing, you could potentially e mail us at 800-456-3000 otherwise check out one of the regional department workplaces today.

Build fund can take a while. It is best supply on your own time from the time you apply for your loan before you can desire to initiate construction. You should give yourself in the 30 days from when you wind up your own plan and you will cost management to obtain the assessment just before their design loan becomes accepted.