Conforming and you can FHA Mortgage Limitations from the Condition

Article on Alaska Mortgage loans

Alaska is the largest condition about You.S. when it comes to rectangular distance, but it possess a population below one million, making it probably the most sparsely inhabited condition. If you’re looking to buy property here, fortunately one to home loan cost inside the Alaska remain the latest federal mediocre. Yet not, home values are higher than the newest You.S. mediocre. Alaskan counties’ compliant mortgage limits are all within high mark, and you may FHA financing limits is highest when you look at the almost a few-thirds of one’s nation’s counties.

National Home loan Prices

- Alaska property taxes

- Alaska old-age taxation

- Alaska income tax calculator

- Learn more about mortgage prices

- How much domestic could you pay for

- Calculate monthly mortgage repayments

- Infographic: Greatest towns and cities to acquire a mortgage

Alaska Mortgages Analysis

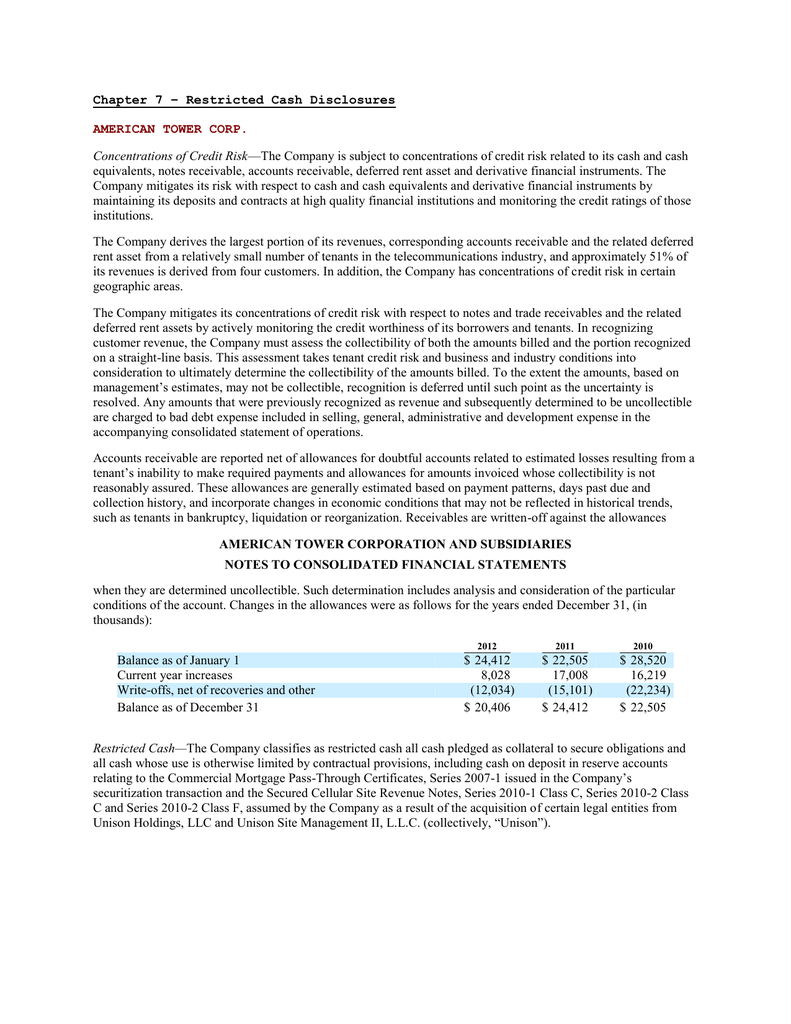

Alaskan a house is more expensive than simply mediocre. Within the Alaska, brand new average household value try $304,900, that’s more than brand new federal average family value of $281,eight hundred, depending on the You.S. Census Agency.

The new conforming mortgage maximum each county about county are $step one,089,300, that’s greater than the high quality $472,030. This is exactly a reflection of the highest a home costs when you look at the Alaska.

It is essential to keep in mind that Alaska is an action out of faith condition, definition when you take away home financing inside the Alaska you will probably make this particular loan file rather than a mortgage document. Lenders which procedure mortgage loans need to go so you’re able to court to foreclose on house that the financial applies to. If the a rely on action is out there instead, the full time and you will costs of going so you can courtroom can be avoided. The lending company can initiate a great energy off selling property foreclosure from the choosing an authorized to help you market the house it really wants to foreclose.

Specific says was “recourse” says, meaning that for many who enter into property foreclosure, a loan provider is actually allowed to go after your assets for any difference between your home’s value and amount owed on your own home loan. Yet not, Alaska are a non-recourse condition, definition you generally wouldn’t be accountable for one difference in a foreclosure.

Alaska has also revelation regulations to safeguard buyers while they are closure to the a house. Alaska Law (AS) establishes if a possible consumer can make a created render on the a residential property, then vendor need certainly to deliver a created revelation declaration for the visitors. However, it certainly is wise to decide for a property check just before closure to the a property.

30-12 months Repaired Home loan Prices inside Alaska

The preferred sort of mortgage about You.S. is actually a thirty-season fixed-price mortgage. It financial constantly makes the very experience having consumers exactly who bundle in which to stay their residence for a long time, given that rate of interest continues to be the same for the duration of the mortgage. Additionally it is simpler to cover these types of financing once the your month-to-month mortgage payments bad credit personal loans Maryland remain an equivalent. Alaska customers may thought a great fifteen-season fixed speed home loan having a diminished rate of interest, however the flip edge of that is one monthly payments is highest.

Alaska Jumbo Mortgage Prices

Residential property for the Alaska are more pricey compared to mediocre U.S. household. This is why, so as to all Alaskan condition has a conforming mortgage restrict regarding $step 1,089,300 more more than the quality $726,two hundred found in the nation. Jumbo financing are the ones you to definitely exceed conforming limitations and are with higher rates of interest. Giving money over conforming constraints merchandise a more impressive risk for loan providers, so the high interest on the jumbo fund combats one to risk.

Alaska Case Financing Cost

A varying-rates home loan (ARM) constantly even offers a lower life expectancy interest upfront than just a fixed-rates home loan. The reduced speed can be found getting a primary several months somewhere within one and 10 years, according to terms of the borrowed funds. After that length of time, the interest rate will typically increase it is capped at the a specific level specified in the regards to the mortgage. Before you sign to a supply to purchase a home when you look at the Alaska, always ensure that the highest possible rate of interest is one that you can be able to shell out.

Alaska Financial Info

Regardless if you are a first-go out homebuyer looking deposit assistance otherwise a senior trying to safe an alternate added new Residential property of Midnight Sunrays, you will find resources for you personally.

The new Alaska Construction Funds Company has the benefit of downpayment guidelines in the particular degree. Their HomeChoice way is free of charge and you can offered to the homeowners, and it also discusses this new tips and you may agreements that include to purchase a home.

The latest Get ready Inlet Housing Expert has software accessible to assist qualified consumers get a hold of affordable houses otherwise discover deposit direction. The newest Prepare Inlet Credit Heart CILC offers personal financing online forums, personal creativity account and very first and you can second mortgages that remove or remove mortgage insurance costs.

Fairbanks Neighborhood Homes Services’ Homeownership Center is going to be a very important resource for your phase of homebuying procedure. It’s got courses to own credit planning, down payment and you will closing advice and you will loans getting restoration otherwise weatherization strategies.

Available Information

Inside the Alaska, you may qualify for help from the us Agency off Farming Rural Advancement. The program is meant to let outlying groups through providing services in securing secure, affordable property. Loans and has are around for some one thinking of buying an effective brand new home otherwise resolve their most recent domestic.

Alaska Home loan Fees

Residents is subtract the loan attention they pay once they file the government taxes. In a number of claims, customers can be twice the deductions by plus mortgage focus repaid on their state taxes as well. However, because the Alaska is one of eight states that doesn’t levy an income tax, one to program will not pertain here.

Alaska Home loan Refinance

Refinancing within the Alaska? You’ll find a couple resources online. Our home Affordable Refinance Program (HARP) has stopped being readily available, but Federal national mortgage association currently even offers its very own option, taking qualifying candidates access to interest and you will principal fee decrease just like the better given that reasonable closing costs.

Even though you don’t quality for 1 ones apps, you might run the financial institution who granted your original financial or any other loan providers to find good re-finance services that really works to possess you.